Growth of Edge Computing

The rise of edge computing in India is influencing the embedded hypervisor-software market. As organizations seek to process data closer to the source, the demand for virtualization solutions that can efficiently manage edge devices is increasing. Embedded hypervisors enable the deployment of multiple applications on edge devices, optimizing performance and reducing latency. This trend is particularly relevant in sectors such as telecommunications and manufacturing, where real-time data processing is essential. The edge computing market in India is projected to reach $5 billion by 2025, suggesting a significant opportunity for embedded hypervisor solutions. By facilitating the management of diverse applications at the edge, embedded hypervisors are likely to play a crucial role in the evolution of digital infrastructure.

Rising Cybersecurity Concerns

As cyber threats become more sophisticated, the need for robust security measures in software systems is paramount. The embedded hypervisor-software market is likely to experience growth as organizations seek to enhance their cybersecurity posture. Embedded hypervisors provide a secure environment by isolating applications and preventing unauthorized access. This capability is particularly crucial in sectors such as finance and healthcare, where data protection is critical. The Indian cybersecurity market is projected to grow at a CAGR of 15% over the next few years, indicating a heightened focus on security solutions. Consequently, the adoption of embedded hypervisor software is expected to increase as businesses prioritize safeguarding their digital assets against potential threats.

Increasing Demand for IoT Solutions

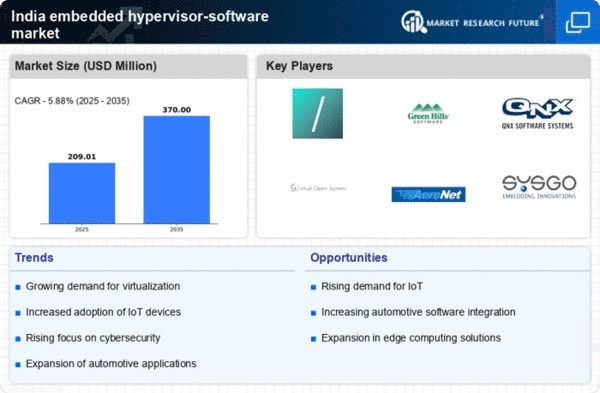

The proliferation of Internet of Things (IoT) devices in India is driving the embedded hypervisor-software market. As industries increasingly adopt IoT technologies, the need for efficient virtualization solutions becomes paramount. Embedded hypervisors enable multiple operating systems to run concurrently on a single hardware platform, facilitating better resource utilization. This trend is particularly evident in sectors such as manufacturing and smart cities, where IoT applications require robust and secure environments. According to recent estimates, the IoT market in India is projected to reach $15 billion by 2025, indicating a substantial opportunity for embedded hypervisor-software market growth. The ability to manage diverse IoT applications through virtualization is likely to enhance operational efficiency and reduce costs, further propelling the demand for embedded hypervisor solutions.

Advancements in Automotive Technology

The automotive sector in India is undergoing a transformation with the integration of advanced technologies such as autonomous driving and connected vehicles. This evolution necessitates the use of embedded hypervisor software to manage complex systems and ensure safety and reliability. As vehicles become more software-driven, the embedded hypervisor-software market is expected to benefit significantly. The Indian automotive industry is anticipated to reach $300 billion by 2026, with a substantial portion allocated to technology development. Embedded hypervisors facilitate the separation of critical safety functions from non-critical applications, thereby enhancing system integrity. This trend suggests a growing reliance on virtualization technologies to support the automotive industry's shift towards smarter, more connected vehicles.

Government Initiatives for Digital Transformation

The Indian government's push for digital transformation across various sectors is likely to bolster the embedded hypervisor-software market. Initiatives such as Digital India aim to enhance connectivity and promote the adoption of advanced technologies. As public services increasingly rely on digital platforms, the demand for secure and efficient virtualization solutions rises. The government's focus on smart infrastructure and e-governance creates a fertile ground for embedded hypervisors, which can support multiple applications on a single hardware platform. With an estimated investment of $1 trillion in digital infrastructure by 2025, the embedded hypervisor-software market stands to gain from these initiatives, as organizations seek to optimize their IT resources and improve service delivery.