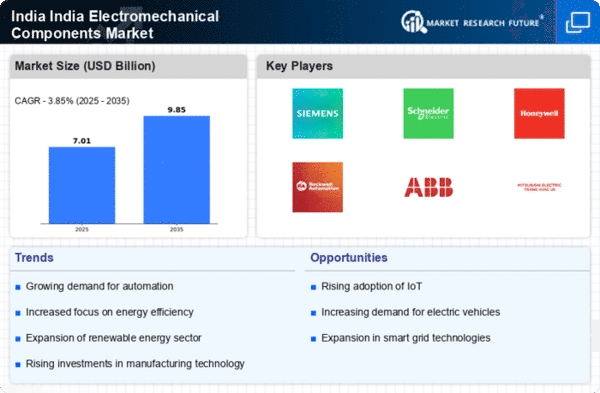

Growing Industrialization in India

The rapid industrialization in India is a pivotal driver for the India Electromechanical Components Market. As various sectors such as manufacturing, automotive, and aerospace expand, the demand for electromechanical components is likely to surge. The government has been promoting initiatives like 'Make in India', which encourages local production and innovation. This has led to an increase in investments in manufacturing facilities, thereby boosting the need for electromechanical components. According to recent data, the manufacturing sector is projected to grow at a CAGR of around 12% over the next few years, further propelling the demand for these components. The integration of advanced technologies in industrial processes also necessitates the use of sophisticated electromechanical components, indicating a robust growth trajectory for the market.

Expansion of Electric Vehicle Market

The burgeoning electric vehicle (EV) market in India is emerging as a key driver for the India Electromechanical Components Market. With the government's push towards electric mobility, there is a growing need for electromechanical components that are integral to EVs, such as motors, controllers, and battery management systems. The National Electric Mobility Mission Plan aims to promote the adoption of electric vehicles, which is expected to lead to a significant increase in the production and sales of EVs. Market forecasts suggest that the EV market in India could reach a valuation of USD 50 billion by 2030, creating a substantial demand for electromechanical components. This trend indicates a promising future for manufacturers in the electromechanical sector as they cater to the evolving needs of the automotive industry.

Increased Focus on Smart Manufacturing

The shift towards smart manufacturing is a notable driver for the India Electromechanical Components Market. As industries embrace Industry 4.0 principles, there is a growing emphasis on integrating advanced technologies such as AI, machine learning, and data analytics into manufacturing processes. This transformation necessitates the use of sophisticated electromechanical components that can support automation and real-time monitoring. The government has been actively promoting smart manufacturing initiatives, which are expected to enhance productivity and efficiency across various sectors. Market analysis indicates that the smart manufacturing sector in India is anticipated to grow at a CAGR of over 15% in the coming years, thereby driving the demand for electromechanical components that are essential for these advanced manufacturing systems.

Rising Demand for Renewable Energy Solutions

The increasing focus on renewable energy sources is a significant driver for the India Electromechanical Components Market. As India aims to achieve its renewable energy targets, particularly in solar and wind energy, the demand for electromechanical components used in these systems is likely to rise. Components such as actuators, relays, and sensors are essential for the efficient operation of renewable energy systems. The government has set ambitious goals to increase the share of renewable energy in the overall energy mix, which is expected to create substantial opportunities for manufacturers of electromechanical components. Recent reports indicate that the renewable energy sector in India is projected to attract investments exceeding USD 20 billion in the next few years, further stimulating the demand for related components.

Technological Advancements in Electromechanical Systems

Technological advancements play a crucial role in shaping the India Electromechanical Components Market. Innovations in automation, robotics, and control systems are driving the demand for more efficient and reliable electromechanical components. The introduction of smart technologies, such as IoT-enabled devices, is transforming traditional manufacturing processes, leading to increased efficiency and reduced operational costs. As industries adopt these technologies, the need for high-performance electromechanical components becomes paramount. Market data suggests that the adoption of automation technologies in India is expected to grow significantly, with a projected increase in the use of robotics in manufacturing by over 30% in the coming years. This trend indicates a strong correlation between technological advancements and the growth of the electromechanical components market.