Growth of Smart Cities

The development of smart cities across India is significantly influencing the edge data-center market. As urban areas evolve into smart ecosystems, the need for real-time data processing and analytics becomes paramount. Smart city initiatives often rely on vast networks of sensors and IoT devices, generating substantial amounts of data that require immediate processing. Edge data centers are ideally positioned to handle this influx of data, providing the necessary infrastructure to support applications such as traffic management, waste management, and public safety. The Indian government has allocated over $1.5 billion for smart city projects, indicating a robust investment in urban infrastructure. This investment is likely to catalyze the growth of the edge data-center market, as these facilities become integral to the operational efficiency of smart cities.

Rising Data Consumption

The edge data-center market in India is experiencing a surge in demand driven by the exponential growth in data consumption. With the proliferation of smartphones and the increasing reliance on digital services, data traffic is projected to rise significantly. According to estimates, data consumption in India is expected to reach 20 exabytes per month by 2025. This escalating demand necessitates the deployment of edge data centers to ensure efficient data processing and reduced latency. As businesses and consumers alike seek faster and more reliable access to information, the edge data-center market is poised to play a crucial role in meeting these needs. The ability to process data closer to the source not only enhances user experience but also alleviates the burden on centralized data centers, thereby driving growth in the edge data-center market in India.

Surge in E-commerce Activities

The rapid expansion of e-commerce in India is a key driver for this market. With online retail sales projected to reach $200 billion by 2026, businesses are increasingly investing in infrastructure that can support their digital operations. Edge data centers provide the necessary capabilities to enhance customer experiences through faster load times and improved service reliability. As e-commerce platforms handle vast amounts of transactional data, the need for efficient data processing becomes critical. This trend is likely to propel the edge data-center market forward, as companies seek to optimize their operations and meet the growing expectations of consumers. The integration of edge computing solutions can facilitate better inventory management, personalized marketing, and enhanced logistics, thereby driving further growth in the sector.

Focus on Data Privacy and Security

In an era where data privacy and security are paramount, the edge data-center market is gaining traction in India. With increasing regulatory scrutiny and consumer awareness regarding data protection, businesses are compelled to adopt solutions that ensure compliance and safeguard sensitive information. Edge data centers offer enhanced security features by processing data closer to the source, thereby minimizing the risk of data breaches during transmission. The Indian government has introduced various regulations aimed at strengthening data protection, which could further stimulate the edge data-center market. As organizations prioritize data security, the demand for localized data processing solutions is likely to rise, positioning edge data centers as a vital component in the broader landscape of data management and compliance.

Increased Adoption of 5G Technology

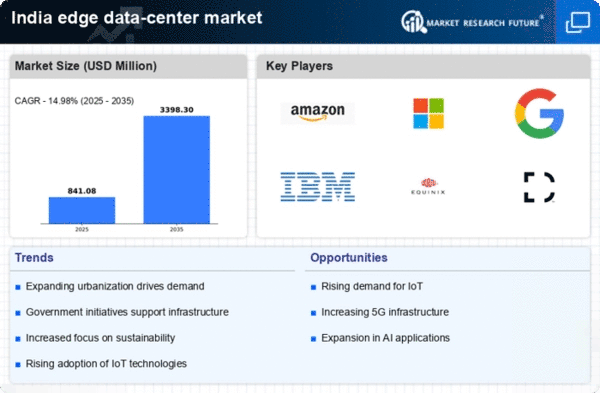

The rollout of 5G technology in India is set to revolutionize the edge data-center market. With its promise of ultra-low latency and high-speed connectivity, 5G is expected to drive the demand for edge computing solutions. As mobile network operators expand their 5G infrastructure, the need for localized data processing becomes critical to leverage the full potential of this technology. The edge data-center market is likely to benefit from this trend, as businesses seek to deploy applications that require real-time data processing, such as augmented reality and autonomous vehicles. Industry analysts predict that the 5G market in India could reach $10 billion by 2025, further underscoring the potential for growth in the edge data-center market as companies adapt to the new technological landscape.