Rising Geriatric Population

The rising geriatric population in India is a crucial driver for the ecg cables-lead-wires market. As the population aged 60 and above is projected to reach 300 million by 2030, the demand for healthcare services, particularly for chronic conditions like heart disease, is expected to escalate. Older adults often require regular monitoring of their cardiovascular health, leading to an increased need for ECG devices and their associated components. This demographic shift necessitates the expansion of healthcare facilities and the procurement of advanced ECG cables and lead wires to cater to the growing patient base. Additionally, the government’s initiatives to improve geriatric care are likely to further enhance the market landscape, as healthcare providers seek to equip themselves with the necessary tools to manage the health of this vulnerable population.

Increasing Healthcare Expenditure

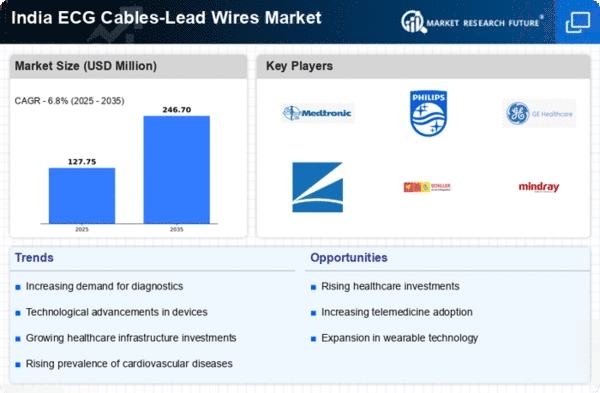

The rising healthcare expenditure in India is a pivotal driver for the ecg cables-lead-wires market. As the government and private sectors allocate more funds towards healthcare infrastructure, the demand for advanced medical equipment, including ECG devices, is likely to surge. In 2025, healthcare spending in India is projected to reach approximately $370 billion, reflecting a growth rate of around 12% annually. This increase in investment not only enhances the availability of ECG machines but also necessitates the procurement of high-quality ECG cables and lead wires, thereby propelling the market forward. Furthermore, the emphasis on improving healthcare facilities in rural areas is expected to create additional demand for these essential components, as hospitals and clinics upgrade their equipment to provide better patient care.

Expansion of Telemedicine Services

The expansion of telemedicine services in India is emerging as a significant driver for the ecg cables-lead-wires market. With the increasing adoption of digital health solutions, healthcare providers are integrating remote monitoring systems that require reliable ECG cables and lead wires. The telemedicine market in India is projected to grow at a CAGR of 20% by 2025, reflecting a shift towards more accessible healthcare delivery. This trend is particularly beneficial for patients in remote areas who may not have easy access to healthcare facilities. As telemedicine becomes more prevalent, the demand for high-quality ECG components is likely to rise, as they are essential for accurate remote monitoring of patients' cardiovascular health. Consequently, this expansion presents a promising opportunity for growth within the ecg cables-lead-wires market.

Technological Innovations in Medical Devices

Technological innovations in medical devices are transforming the landscape of the ecg cables-lead-wires market. The introduction of advanced materials and designs in ECG cables enhances their performance, durability, and patient comfort. Innovations such as wireless ECG monitoring systems are gaining traction, allowing for greater mobility and convenience in patient care. In 2025, the market for wireless ECG devices is anticipated to grow at a CAGR of 15%, indicating a shift towards more sophisticated monitoring solutions. These advancements not only improve the accuracy of readings but also reduce the risk of equipment failure, thereby increasing the reliance on high-quality lead wires and cables. As manufacturers continue to invest in research and development, the ecg cables-lead-wires market is poised for substantial growth driven by these technological advancements.

Growing Prevalence of Cardiovascular Diseases

The escalating prevalence of cardiovascular diseases (CVDs) in India serves as a significant driver for the ecg cables-lead-wires market. With CVDs accounting for nearly 28% of all deaths in the country, the urgency for effective monitoring and diagnostic tools has never been greater. The Indian healthcare system is increasingly focusing on early detection and management of heart-related ailments, which necessitates the use of ECG devices. As hospitals and clinics expand their cardiology departments, the demand for reliable ECG cables and lead wires is expected to rise. Moreover, the increasing awareness among the population regarding heart health is likely to contribute to a higher utilization of ECG services, further stimulating market growth. This trend indicates a robust future for the ecg cables-lead-wires market as healthcare providers seek to enhance their diagnostic capabilities.