Expansion of 5G Infrastructure

The rollout of 5G technology in India is poised to be a major catalyst for the distributed edge-cloud market. With its promise of ultra-fast data transfer speeds and reduced latency, 5G enables a new wave of applications that require immediate data processing at the edge. This includes advancements in augmented reality, autonomous vehicles, and smart cities. The Indian government has been actively promoting the deployment of 5G networks, which is expected to cover a substantial portion of urban areas by 2026. As 5G infrastructure expands, the demand for distributed edge-cloud solutions will likely increase, allowing businesses to harness the full potential of this technology. The integration of 5G with edge computing is anticipated to create a robust ecosystem that enhances connectivity and drives innovation across various sectors, thereby propelling the growth of the distributed edge-cloud market.

Growth of Smart Cities Initiatives

The distributed edge-cloud market in India is significantly influenced by the government's push towards smart city initiatives. These projects aim to enhance urban living through the integration of technology in infrastructure, transportation, and public services. As cities become smarter, the need for efficient data processing and management at the edge becomes increasingly critical. Smart city applications, such as traffic management systems and public safety monitoring, require real-time data analysis to function effectively. The Indian government has allocated substantial funding for smart city projects, which is expected to drive investments in distributed edge-cloud solutions. This growth presents a unique opportunity for service providers to offer tailored solutions that meet the specific needs of urban environments, thereby fostering the expansion of the distributed edge-cloud market.

Increased Focus on Data Sovereignty

In India, the distributed edge-cloud market is witnessing a heightened emphasis on data sovereignty and localization. As data privacy regulations become more stringent, organizations are compelled to ensure that sensitive data remains within national borders. This trend is particularly relevant in sectors such as finance and healthcare, where compliance with local laws is critical. The Indian government has introduced various initiatives aimed at promoting data localization, which in turn drives the demand for edge computing solutions that can store and process data locally. By leveraging distributed edge-cloud architectures, businesses can address these regulatory requirements while optimizing their data management strategies. This focus on data sovereignty is likely to shape the future landscape of the distributed edge-cloud market, as companies seek to balance compliance with operational efficiency.

Rising Demand for Real-Time Data Processing

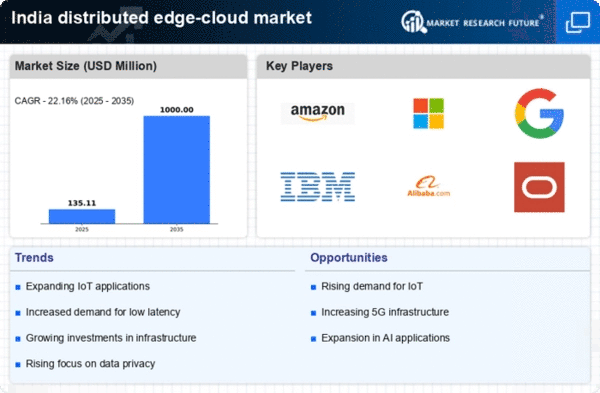

The distributed edge-cloud market in India is experiencing a surge in demand for real-time data processing capabilities. As businesses increasingly rely on data-driven decision-making, the need for low-latency processing becomes paramount. Industries such as manufacturing, healthcare, and finance are adopting edge computing solutions to enhance operational efficiency and improve customer experiences. According to recent estimates, the market for edge computing in India is projected to grow at a CAGR of approximately 30% over the next five years. This growth is driven by the necessity for immediate data analysis and response, which is critical in sectors where time-sensitive decisions are essential. Consequently, the distributed edge-cloud market is positioned to benefit significantly from this trend, as organizations seek to leverage edge capabilities to meet their real-time processing needs.

Emergence of AI and Machine Learning Applications

The rise of artificial intelligence (AI) and machine learning (ML) technologies is having a profound impact on the distributed edge-cloud market in India. As organizations seek to implement AI-driven solutions, the need for processing power at the edge becomes increasingly apparent. Edge computing allows for the efficient execution of AI algorithms, enabling real-time insights and decision-making. Industries such as retail, agriculture, and logistics are beginning to adopt AI and ML applications that rely on distributed edge-cloud architectures to enhance operational efficiency and customer engagement. The market for AI in India is projected to reach $7.8 billion by 2025, indicating a robust growth trajectory. This trend suggests that the distributed edge-cloud market will likely expand in tandem with the increasing adoption of AI and ML technologies, as businesses strive to leverage these innovations for competitive advantage.