Rising Healthcare Expenditure

The India disposable endoscope market is benefiting from the increasing healthcare expenditure by both the government and private sectors. The Indian government has been investing significantly in healthcare infrastructure, aiming to improve access to quality medical services. This investment includes the procurement of advanced medical equipment, such as disposable endoscopes, which are essential for modern diagnostic practices. In recent years, healthcare spending has seen a steady increase, with projections indicating a rise to 3.5% of GDP by 2025. This growing expenditure is likely to enhance the availability of disposable endoscopes in hospitals and clinics, thereby driving market growth. Additionally, the expansion of private healthcare facilities is expected to further boost demand for these innovative diagnostic tools.

Technological Advancements in Endoscopy

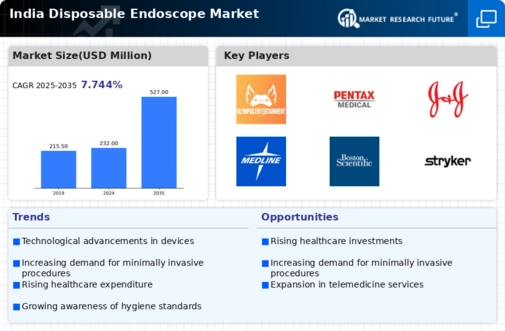

The India disposable endoscope market is experiencing a surge due to rapid technological advancements. Innovations in imaging technology, such as high-definition cameras and flexible designs, enhance diagnostic capabilities. These advancements not only improve patient outcomes but also increase the efficiency of procedures. The integration of artificial intelligence in endoscopic procedures is also gaining traction, potentially streamlining workflows and reducing the time required for diagnosis. As hospitals and clinics adopt these technologies, the demand for disposable endoscopes is likely to rise, reflecting a shift towards more efficient and effective healthcare solutions. Furthermore, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 12% over the next five years, indicating a robust expansion driven by these technological improvements.

Growing Demand for Outpatient Procedures

The shift towards outpatient procedures is reshaping the India disposable endoscope market. As healthcare systems aim to reduce costs and improve patient convenience, there is a notable trend towards performing endoscopic procedures in outpatient settings. Disposable endoscopes are particularly well-suited for this environment, as they eliminate the need for reprocessing and sterilization, thus streamlining the workflow. This trend is supported by the increasing preference of patients for minimally invasive procedures that allow for quicker recovery times. As outpatient services continue to grow, the demand for disposable endoscopes is expected to rise, indicating a significant opportunity for market expansion.

Focus on Patient Safety and Infection Control

The emphasis on patient safety and infection control is a critical driver for the India disposable endoscope market. With increasing awareness of healthcare-associated infections, hospitals are prioritizing the use of single-use medical devices, including disposable endoscopes. These devices significantly reduce the risk of cross-contamination, aligning with global best practices in infection prevention. Regulatory bodies in India are also advocating for stringent infection control measures, which further supports the adoption of disposable endoscopes. As healthcare providers strive to enhance patient safety, the market for disposable endoscopes is likely to expand, reflecting a broader trend towards safer medical practices.

Increasing Prevalence of Gastrointestinal Disorders

The rising incidence of gastrointestinal disorders in India is a significant driver for the disposable endoscope market. Conditions such as irritable bowel syndrome, colorectal cancer, and peptic ulcers are becoming increasingly common, necessitating effective diagnostic tools. According to recent health reports, gastrointestinal diseases account for a substantial percentage of hospital admissions, highlighting the urgent need for efficient diagnostic solutions. Disposable endoscopes offer a practical solution, as they reduce the risk of cross-contamination and are cost-effective for healthcare facilities. As awareness of gastrointestinal health increases among the population, the demand for disposable endoscopes is expected to grow, further propelling the market forward.