Enhanced Safety and Security Measures

Safety and security are paramount in the digital railway market, particularly in a country as populous as India. The implementation of advanced surveillance systems and automated safety protocols is becoming increasingly critical. Technologies such as AI-driven monitoring systems and predictive analytics are being utilized to preemptively identify potential hazards. The Indian Railways has reported a reduction in accidents by approximately 25% due to the adoption of these digital safety measures. This focus on safety not only protects passengers but also enhances the overall reliability of the railway system. As safety concerns continue to drive consumer preferences, the digital railway market is likely to see sustained growth in response to these demands.

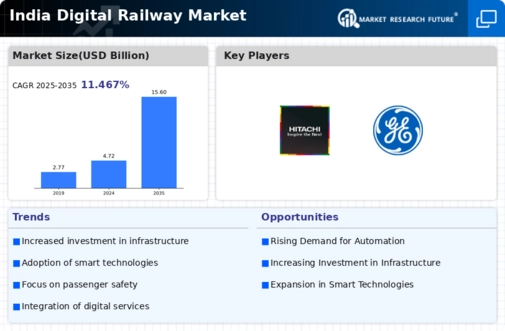

Government Initiatives and Investments

The digital railway market in India is experiencing a surge due to proactive government initiatives aimed at modernizing railway infrastructure. The Indian government has allocated substantial funds, approximately $10 billion, for the development of smart railway systems. This investment is expected to enhance operational efficiency and safety. Furthermore, initiatives such as the National Rail Plan aim to create a future-ready railway system by 2030, which includes the integration of digital technologies. These efforts not only improve service delivery but also attract private investments, thereby fostering a competitive environment in the digital railway market. The government's commitment to enhancing connectivity and reducing travel time through digital solutions is likely to drive growth in this sector.

Growing Urbanization and Population Density

India's rapid urbanization and increasing population density are significant drivers of the digital railway market. With urban areas expanding, the demand for efficient and reliable public transport systems is escalating. The digital railway market is poised to address these challenges by offering solutions that enhance capacity and reduce congestion. For instance, the implementation of smart ticketing systems and real-time tracking can improve passenger experience and operational efficiency. Reports indicate that urban rail systems could see a growth rate of 15% annually, reflecting the urgent need for modernized railway solutions. This trend underscores the importance of digital transformation in meeting the transportation needs of a growing urban populace.

Technological Advancements in Communication

Advancements in communication technologies are playing a pivotal role in shaping the digital railway market in India. The introduction of 5G technology is expected to revolutionize real-time data transmission, enabling seamless communication between trains and control centers. This could lead to improved safety measures and operational efficiency. Moreover, the integration of Internet of Things (IoT) devices allows for better monitoring of train conditions and passenger services. As per estimates, the adoption of these technologies could enhance operational efficiency by up to 30%. Consequently, the digital railway market is likely to benefit from these innovations, which facilitate better decision-making and resource allocation.

Focus on Sustainability and Environmental Impact

The digital railway market in India is increasingly influenced by sustainability. The government has set ambitious targets to achieve net-zero emissions by 2070, prompting the railway sector to adopt greener technologies. Digital solutions, such as energy-efficient trains and smart energy management systems, are being prioritized to minimize carbon footprints. The integration of renewable energy sources into railway operations is also gaining traction. It is estimated that transitioning to digital solutions could reduce energy consumption by up to 20%. This shift not only aligns with The digital railway market to environmentally conscious stakeholders.