India Dental Software Market Summary

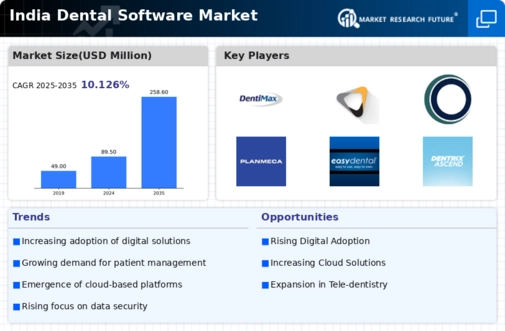

The India Dental Software Market is projected to grow significantly from 89.5 USD Million in 2024 to 258.6 USD Million by 2035.

Key Market Trends & Highlights

India Dental Software Market Key Trends and Highlights

- The market is expected to expand at a compound annual growth rate (CAGR) of 10.13% from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 258.6 USD Million, indicating robust growth potential.

- In 2024, the market is valued at 89.5 USD Million, reflecting a strong foundation for future development.

- Growing adoption of digital technologies due to increasing demand for efficient dental practices is a major market driver.

Market Size & Forecast

| 2024 Market Size | 89.5 (USD Million) |

| 2035 Market Size | 258.6 (USD Million) |

| CAGR (2025-2035) | 10.13% |

Major Players

DentiMax, Carestream Dental, Zirconia Solutions, Dentsofte, Dreams Dental, Oracare, Open Dental, NexDent, Planmeca, Easy Dental, Kavo Kerr, Practitioner, Bridge, Byte Dental, Dentrix, Exan Group