Rising Healthcare Expenditure

An increase in healthcare expenditure in India is contributing to the growth of the deep vein-thrombosis-treatment market. With the government and private sectors investing more in healthcare, patients are gaining access to better treatment options. The healthcare expenditure in India is expected to reach approximately 4% of GDP by 2025, reflecting a growing commitment to improving health services. This rise in expenditure allows for the procurement of advanced treatment modalities and medications for DVT, which may not have been accessible previously. Consequently, as healthcare budgets expand, the deep vein-thrombosis-treatment market is likely to see a surge in demand for innovative therapies and comprehensive care solutions.

Increasing Incidence of Risk Factors

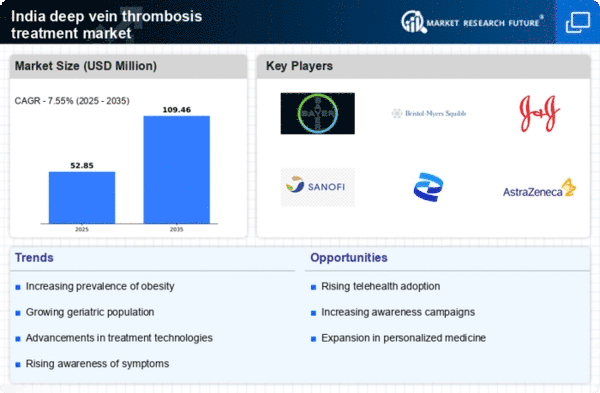

The deep vein-thrombosis-treatment market in India is experiencing growth due to the rising incidence of risk factors associated with DVT. Conditions such as obesity, sedentary lifestyles, and an aging population contribute to a higher prevalence of deep vein thrombosis. According to recent health statistics, approximately 30% of the adult population in urban areas is classified as overweight or obese, which significantly increases the risk of DVT. Furthermore, the aging demographic, with over 8% of the population aged 60 and above, is likely to exacerbate the situation. This growing incidence of risk factors necessitates effective treatment options, thereby driving demand within the deep vein-thrombosis-treatment market. As healthcare providers become more aware of these trends, they are likely to invest in advanced treatment modalities to address the increasing patient needs.

Growing Focus on Preventive Healthcare

The deep vein-thrombosis-treatment market is also influenced by a growing focus on preventive healthcare measures. As awareness about DVT increases, healthcare providers are emphasizing the importance of prevention strategies, such as lifestyle modifications and prophylactic treatments. Educational campaigns aimed at high-risk populations are becoming more prevalent, encouraging individuals to adopt healthier lifestyles. This shift towards prevention is likely to reduce the incidence of DVT, but it also creates a demand for preventive treatments and monitoring solutions. The market is expected to adapt by offering a range of products and services that cater to this preventive approach, thereby enhancing the overall landscape of the deep vein-thrombosis-treatment market.

Advancements in Diagnostic Technologies

The deep vein-thrombosis-treatment market is being propelled by advancements in diagnostic technologies that enhance the detection and management of DVT. Innovations such as portable ultrasound devices and advanced imaging techniques have improved the accuracy and speed of diagnosis. For instance, the use of Doppler ultrasound has become a standard practice in identifying DVT, allowing for timely intervention. The market for diagnostic imaging in India is projected to grow at a CAGR of 10% over the next five years, indicating a robust demand for effective diagnostic tools. As healthcare facilities adopt these technologies, the early detection of DVT will likely lead to increased treatment rates, thereby positively impacting the deep vein-thrombosis-treatment market.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving healthcare infrastructure and access to treatment are playing a crucial role in the deep vein-thrombosis-treatment market. The Indian government has launched various health schemes to enhance awareness and provide better access to medical services. For instance, the National Health Mission focuses on reducing the burden of non-communicable diseases, including DVT. Additionally, the introduction of health insurance schemes has made treatments more affordable for a larger segment of the population. As a result, the deep vein-thrombosis-treatment market is likely to benefit from increased patient access to diagnostic and therapeutic services, leading to a rise in treatment uptake. These policies not only promote awareness but also encourage healthcare providers to adopt innovative treatment solutions.