Rising Security Concerns

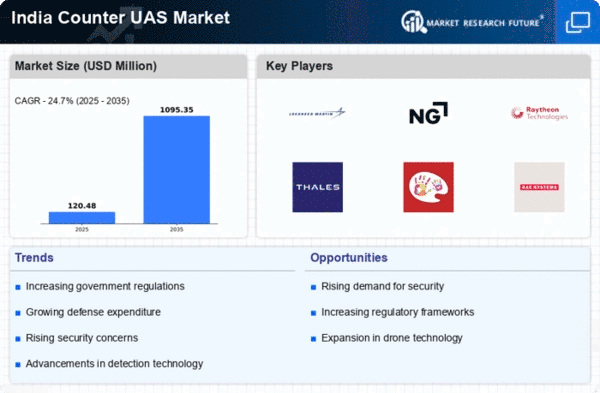

The market in India is experiencing growth due to escalating security concerns across various sectors. With the increasing incidents of unauthorized drone activities, both governmental and private entities are prioritizing the implementation of counter-drone technologies. The Indian government has recognized the potential threats posed by drones, particularly in sensitive areas such as military installations and critical infrastructure. As a result, investments in counter uas systems are projected to rise significantly, with estimates suggesting a growth rate of approximately 15% annually. This heightened focus on security is likely to drive demand for advanced detection and neutralization systems, thereby propelling the counter uas market forward.

Commercial Sector Expansion

The expansion of the commercial sector in India is contributing to the growth of the counter uas market. As industries such as logistics, agriculture, and construction increasingly adopt drone technology for operational efficiency, the need for counter uas solutions becomes more pronounced. Companies are recognizing the risks associated with drone misuse, prompting them to invest in protective measures. Market analysis indicates that the commercial segment could account for nearly 30% of the overall counter uas market by 2026. This trend underscores the necessity for robust counter-drone systems to mitigate potential disruptions and ensure safe operations across various industries.

Public Awareness and Education

Public awareness and education regarding drone threats are emerging as critical drivers for the counter uas market in India. As incidents of drone-related security breaches become more widely reported, both the public and private sectors are recognizing the importance of counter measures. Educational initiatives aimed at informing stakeholders about the risks associated with drones are gaining traction. This increased awareness is likely to lead to higher demand for counter uas solutions, as organizations seek to protect their assets and ensure compliance with regulations. The counter uas market could see a notable uptick in growth, potentially reaching a valuation of $500 million by 2027, driven by this heightened awareness.

Defense Modernization Initiatives

India's defense modernization initiatives are significantly influencing the counter uas market. The government is actively seeking to enhance its military capabilities, particularly in the realm of aerial defense. This includes the integration of counter uas technologies to safeguard against potential drone threats. The Indian Ministry of Defense has allocated substantial budgets for research and development in this area, with projections indicating an increase in spending by around 20% over the next five years. Such initiatives not only bolster national security but also stimulate the counter uas market by encouraging domestic production and innovation in drone defense systems.

Technological Innovations in Detection Systems

Technological innovations in detection systems are reshaping the counter uas market landscape in India. Advancements in radar, radio frequency, and electro-optical systems are enhancing the capabilities of counter-drone solutions. These innovations enable more accurate identification and tracking of unauthorized drones, thereby improving response times and effectiveness. The Indian market is witnessing a surge in demand for these sophisticated systems, with estimates suggesting a growth of around 25% in the next few years. As technology continues to evolve, the counter uas market is likely to benefit from enhanced performance and reliability, attracting further investments and interest from various sectors.