Emergence of Predictive Analytics

The emergence of predictive analytics is reshaping the landscape of the contact center-analytics market in India. Organizations are increasingly adopting predictive models to anticipate customer needs and behaviors, thereby enhancing service delivery. This trend is expected to drive a growth rate of around 25% in the predictive analytics segment over the next few years. By utilizing historical data and advanced algorithms, businesses can forecast trends and proactively address customer inquiries. The ability to predict customer behavior not only improves satisfaction but also optimizes resource allocation within contact centers. As predictive analytics becomes more accessible, its integration into the contact center-analytics market is likely to transform how organizations engage with their customers.

Expansion of Cloud-Based Solutions

The shift towards cloud-based solutions is significantly influencing the contact center-analytics market in India. With the increasing adoption of cloud technologies, businesses are able to access advanced analytics tools without the need for substantial upfront investments. This transition is expected to facilitate scalability and flexibility, allowing organizations to adapt to changing market demands. Reports indicate that the cloud segment of the contact center-analytics market is anticipated to grow by over 30% in the coming years. The ability to store and analyze vast amounts of data in real-time enhances decision-making processes and improves customer engagement strategies. As more companies migrate to cloud platforms, the demand for integrated analytics solutions is likely to rise, further propelling the growth of the contact center-analytics market.

Rising Demand for Data-Driven Insights

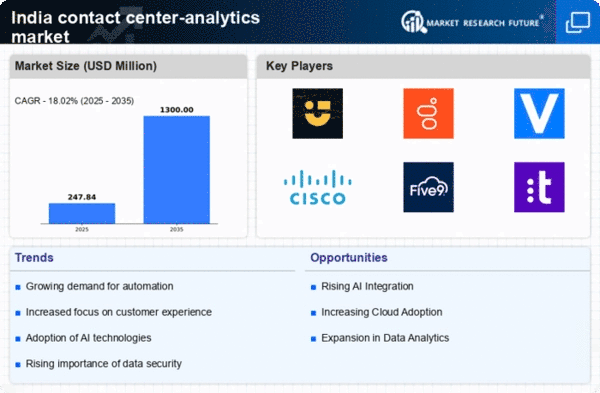

the market in India is experiencing a notable surge in demand for data-driven insights.. Organizations are increasingly recognizing the value of analytics in enhancing operational efficiency and customer satisfaction. According to recent estimates, the market is projected to grow at a CAGR of approximately 20% over the next five years. This growth is driven by the need for businesses to leverage data to make informed decisions, optimize resource allocation, and improve service delivery. As companies strive to remain competitive, the integration of advanced analytics tools becomes essential. The ability to analyze customer interactions and feedback allows organizations to identify trends and areas for improvement, thereby fostering a culture of continuous enhancement within the contact center-analytics market.

Growing Focus on Workforce Optimization

Workforce optimization is emerging as a pivotal driver in the contact center-analytics market in India. Organizations are increasingly investing in analytics solutions that enhance workforce management, aiming to improve employee productivity and service quality. By leveraging analytics, companies can gain insights into agent performance, customer interactions, and operational workflows. This focus on optimization is projected to lead to a growth rate of approximately 18% in the workforce analytics segment. The ability to analyze performance metrics and identify training needs enables organizations to create a more efficient workforce. As businesses strive to enhance their service delivery, the integration of workforce optimization tools within the contact center-analytics market is likely to become a standard practice.

Regulatory Compliance and Data Security

In the context of the contact center-analytics market, regulatory compliance and data security are becoming increasingly critical. Organizations are required to adhere to stringent data protection regulations, which necessitate the implementation of robust analytics solutions. The emphasis on safeguarding customer data is driving investments in advanced security measures and compliance frameworks. As a result, companies are seeking analytics tools that not only provide insights but also ensure data integrity and confidentiality. The market is witnessing a shift towards solutions that incorporate security features, which is expected to contribute to a growth rate of around 15% in the analytics segment focused on compliance. This trend underscores the importance of balancing analytics capabilities with the need for stringent data protection in the contact center-analytics market.