Rising Urbanization Trends

Urbanization in India is accelerating, with the urban population projected to reach 600 million by 2031. This rapid urban growth is driving the construction mining-equipment market as cities expand and require new infrastructure. The demand for residential, commercial, and industrial buildings is increasing, necessitating the use of advanced construction mining equipment for efficient project execution. Additionally, urbanization leads to the development of transportation networks, which further fuels the need for heavy machinery. The construction mining-equipment market is likely to benefit from this trend, as companies invest in modern equipment to meet the challenges posed by urban development. The integration of technology in construction processes is also expected to enhance productivity and reduce project timelines.

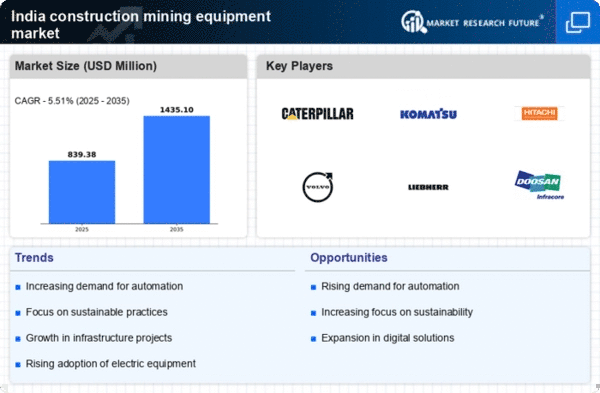

Focus on Sustainable Practices

Sustainability is becoming a crucial focus in the construction mining-equipment market as companies strive to minimize their environmental impact. The Indian government has set ambitious targets for reducing carbon emissions and promoting green construction practices. This shift is prompting manufacturers to develop eco-friendly equipment that meets stringent environmental standards. The adoption of electric and hybrid machinery is on the rise, as these options offer reduced emissions and lower operating costs. Additionally, sustainable practices in construction, such as recycling materials and using energy-efficient equipment, are gaining traction. As a result, the construction mining-equipment market is likely to see increased demand for sustainable solutions that align with the broader goals of environmental conservation.

Increased Investment in Mining Sector

The mining sector in India is witnessing increased investment, which is positively impacting the construction mining-equipment market. The government has introduced policies to attract foreign direct investment (FDI) in mining, aiming to enhance mineral production and reduce import dependency. With the mining industry projected to grow at a CAGR of 6.5% from 2021 to 2026, the demand for construction mining equipment is expected to rise significantly. This growth is driven by the need for advanced machinery to extract minerals efficiently and safely. As mining operations expand, companies are likely to invest in modern equipment to improve productivity and comply with safety regulations. Consequently, the construction mining-equipment market is set to benefit from the revitalization of the mining sector.

Infrastructure Development Initiatives

The construction mining-equipment market in India is experiencing a surge due to extensive infrastructure development initiatives undertaken by the government. The National Infrastructure Pipeline (NIP) aims to invest approximately $1.4 trillion in infrastructure projects by 2025, which includes roads, railways, and urban development. This ambitious plan is likely to drive demand for construction mining equipment, as these projects require advanced machinery for excavation, material handling, and site preparation. Furthermore, the push for smart cities and urban renewal projects necessitates the use of modern equipment to ensure efficiency and sustainability. As a result, the construction mining-equipment market is poised for growth, with manufacturers focusing on innovative solutions to meet the increasing demand from infrastructure projects.

Technological Integration in Equipment

The construction mining-equipment market is increasingly influenced by the integration of advanced technologies in machinery. Innovations such as automation, telematics, and artificial intelligence are transforming the way construction and mining operations are conducted. These technologies enhance operational efficiency, reduce downtime, and improve safety standards. For instance, the use of telematics allows for real-time monitoring of equipment performance, enabling timely maintenance and reducing operational costs. As companies seek to optimize their operations, the demand for technologically advanced construction mining equipment is likely to rise. This trend indicates a shift towards smarter, more efficient machinery that can adapt to the evolving needs of the construction mining-equipment market.