India Construction Industry Investment Analysis Market Summary

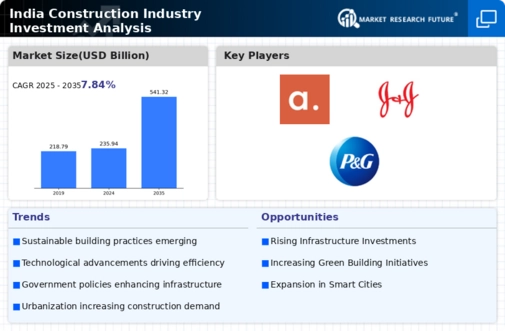

The India construction industry is projected to experience substantial growth, reaching 541.32 USD Billion by 2035.

Key Market Trends & Highlights

India Construction Industry Investment Analysis Market Key Trends and Highlights

- The market is valued at 235.94 USD Billion in 2024, indicating a robust starting point for future investments.

- From 2025 to 2035, the industry is expected to grow at a compound annual growth rate (CAGR) of 7.84%.

- By 2035, the market is anticipated to expand to 541.32 USD Billion, reflecting a significant increase in construction activities.

- Growing adoption of sustainable building practices due to increasing environmental regulations is a major market driver.

Market Size & Forecast

| 2024 Market Size | 235.94 (USD Billion) |

| 2035 Market Size | 541.32 (USD Billion) |

| CAGR (2025 - 2035) | 7.84% |

Major Players

Shapoorji Pallonji Group, PNC Infratech, Larsen & Toubro, GMR Infrastructure, IRCON International, UltraTech Cement, Ambuja Cements, ACC Limited, DLF, Hindustan Construction Company, Adani Group, JK Cement, Gammon India, Jindal Steel & Power, Tata Projects