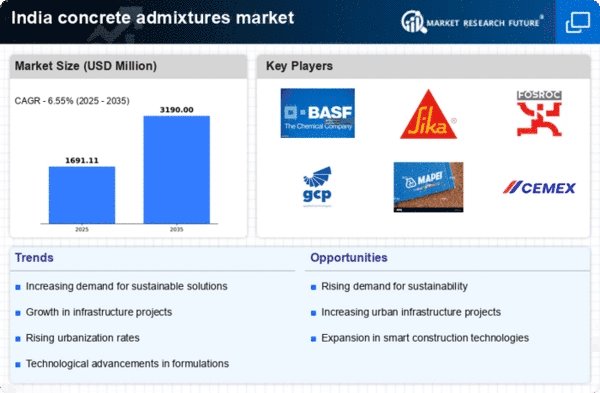

The concrete admixtures market in India is characterized by a dynamic competitive landscape, driven by increasing urbanization, infrastructure development, and a growing emphasis on sustainability. Major players such as BASF SE (DE), Sika AG (CH), and GCP Applied Technologies Inc (US) are strategically positioned to leverage these growth drivers. BASF SE (DE) focuses on innovation and sustainability, emphasizing the development of eco-friendly products, while Sika AG (CH) has been expanding its regional footprint through strategic acquisitions and partnerships. GCP Applied Technologies Inc (US) is enhancing its operational efficiency through digital transformation initiatives, which collectively shape a competitive environment that prioritizes innovation and sustainability.Key business tactics in this market include localizing manufacturing and optimizing supply chains to enhance responsiveness to regional demands. The competitive structure appears moderately fragmented, with several key players influencing market dynamics. This fragmentation allows for a diverse range of products and solutions, catering to various customer needs while fostering competition among established and emerging players.

In September Sika AG (CH) announced the acquisition of a local admixture manufacturer, which is expected to bolster its market presence in India. This strategic move not only enhances Sika's product portfolio but also facilitates access to local expertise and distribution networks, thereby strengthening its competitive position. The acquisition aligns with Sika's broader strategy of expanding its operational capabilities in high-growth markets.

In October GCP Applied Technologies Inc (US) launched a new line of sustainable concrete admixtures designed to reduce carbon emissions during production. This initiative reflects the company's commitment to sustainability and positions it favorably in a market increasingly driven by environmental considerations. The introduction of these products is likely to attract environmentally conscious customers and enhance GCP's brand reputation.

In August BASF SE (DE) unveiled a digital platform aimed at optimizing the performance of concrete admixtures through real-time data analytics. This platform is expected to provide customers with tailored solutions, enhancing their operational efficiency. By integrating digital technologies into its offerings, BASF is not only improving customer engagement but also setting a benchmark for innovation in the industry.

As of November current competitive trends in the concrete admixtures market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are shaping the landscape, fostering collaboration that enhances product development and market reach. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to deliver sustainable and technologically advanced solutions.