Advancements in Imaging Technologies

Advancements in imaging technologies are significantly influencing the computer vision-healthcare market in India. Innovations such as high-resolution imaging, 3D imaging, and real-time analysis are enhancing the capabilities of healthcare professionals. These technologies enable more accurate and timely diagnoses, which are crucial for effective treatment plans. The integration of artificial intelligence with imaging technologies is further propelling this market, as it allows for automated analysis and interpretation of medical images. Reports suggest that the imaging segment within the computer vision-healthcare market is expected to account for over 40% of the total market share by 2026. This growth is indicative of the increasing reliance on advanced imaging solutions to improve clinical outcomes and patient care.

Growing Focus on Preventive Healthcare

There is a growing focus on preventive healthcare in India, which is positively impacting the computer vision-healthcare market. As awareness about health and wellness increases, both patients and healthcare providers are prioritizing early detection and prevention of diseases. Computer vision technologies are being leveraged to analyze medical images and identify potential health issues before they escalate. This proactive approach not only improves patient outcomes but also reduces healthcare costs in the long run. The market for preventive healthcare solutions is projected to grow significantly, with estimates suggesting a CAGR of around 25% over the next few years. This trend indicates that the computer vision-healthcare market will likely see increased adoption as healthcare systems shift towards preventive measures.

Integration of Wearable Health Technologies

The integration of wearable health technologies is emerging as a key driver for the computer vision-healthcare market in India. Wearables equipped with computer vision capabilities are enabling continuous monitoring of patients' health metrics, providing real-time data to healthcare providers. This integration facilitates timely interventions and personalized treatment plans, enhancing overall patient care. The market for wearable health devices is expected to grow substantially, with projections indicating a value of $10 billion by 2026. As more individuals adopt these technologies, the demand for computer vision solutions that can analyze and interpret the data generated by wearables is likely to increase. This trend underscores the potential of the computer vision-healthcare market to revolutionize patient monitoring and management.

Rising Investment in Healthcare Infrastructure

The computer vision-healthcare market is benefiting from rising investments in healthcare infrastructure across India. The government and private sectors are increasingly allocating funds to modernize healthcare facilities and integrate advanced technologies. This investment trend is aimed at improving healthcare delivery and accessibility, particularly in rural and underserved areas. As part of this initiative, the adoption of computer vision technologies is being prioritized to enhance diagnostic capabilities and patient monitoring. It is estimated that the healthcare infrastructure investment in India could reach $370 billion by 2025, which will likely bolster the growth of the computer vision-healthcare market. This influx of capital is expected to facilitate the development and deployment of innovative solutions that can address the challenges faced by the healthcare system.

Increasing Demand for Efficient Healthcare Solutions

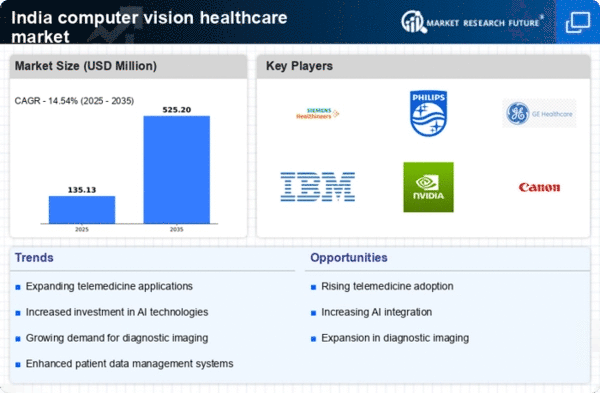

The computer vision-healthcare market in India is experiencing a surge in demand for efficient healthcare solutions. This demand is driven by the need to enhance diagnostic accuracy and reduce operational costs. With a growing population and increasing prevalence of chronic diseases, healthcare providers are seeking innovative technologies that can streamline processes. The integration of computer vision technologies into healthcare systems is expected to improve patient outcomes and optimize resource allocation. According to recent estimates, the market is projected to grow at a CAGR of approximately 30% over the next five years, indicating a robust expansion in the adoption of these technologies. As healthcare facilities strive to meet the rising expectations of patients, the computer vision-healthcare market is likely to play a pivotal role in transforming the landscape of medical diagnostics and treatment.