Rise of Startups and SMEs

The proliferation of startups and small to medium enterprises (SMEs) in India is significantly impacting the company secretarial-software market. With the startup ecosystem thriving, there is a growing need for efficient management of corporate compliance and governance. In 2025, it is estimated that the number of registered startups in India will exceed 50,000, many of which will require robust software solutions to manage their secretarial functions. This surge in new businesses is likely to create a substantial demand for company secretarial software, as these entities seek to establish sound governance practices from the outset.

Increased Focus on Data Analytics

The emphasis on data analytics within corporate environments is emerging as a key driver for the company secretarial-software market. Organizations are recognizing the value of data-driven decision-making and are seeking software solutions that provide analytical insights into compliance and governance processes. By 2025, it is projected that around 40% of companies in India will utilize analytics-driven company secretarial software to enhance their operational strategies. This trend suggests a growing integration of data analytics capabilities within secretarial functions, thereby fostering a more informed approach to corporate governance.

Digital Transformation Initiatives

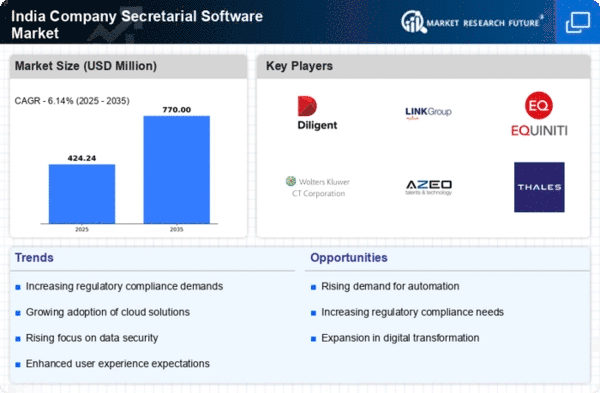

As businesses in India increasingly embrace digital transformation, the company secretarial-software market is experiencing significant growth. Organizations are investing in technology to enhance operational efficiency and improve decision-making processes. In 2025, it is projected that the digital transformation spending in India will reach approximately $100 billion, with a substantial portion allocated to software solutions that facilitate corporate governance and compliance. This shift towards digital tools is likely to drive the adoption of company secretarial software, as firms seek to automate routine tasks and improve data accuracy, thereby enhancing overall productivity.

Regulatory Compliance Requirements

The increasing complexity of regulatory compliance in India is a primary driver for the company secretarial-software market. Companies are mandated to adhere to various laws and regulations, including the Companies Act, 2013, and the Income Tax Act. This has led to a growing demand for software solutions that can streamline compliance processes. In 2025, it is estimated that around 70% of businesses in India will rely on automated solutions to ensure compliance, reducing the risk of penalties and enhancing operational efficiency. The company secretarial-software market is thus positioned to benefit from this trend, as organizations seek to mitigate compliance risks and improve their governance frameworks.

Growing Demand for Corporate Governance

The heightened focus on corporate governance in India is a crucial driver for the company secretarial-software market. Stakeholders, including investors and regulatory bodies, are increasingly demanding transparency and accountability from organizations. In response, companies are adopting software solutions that enable better governance practices. By 2025, it is anticipated that over 60% of large corporations will implement advanced company secretarial software to enhance their governance frameworks. This trend indicates a shift towards more structured and transparent corporate practices, which is likely to bolster the market for company secretarial software.