India Collation Shrink Films Market Summary

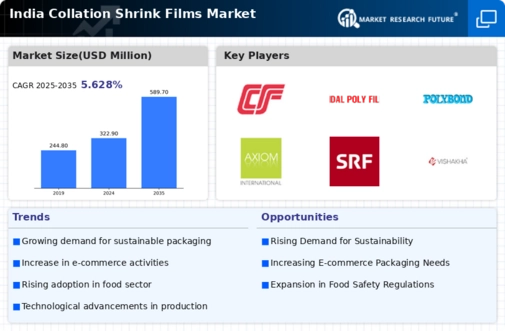

The India Collation Shrink Films Market is projected to grow from 322.9 USD Million in 2024 to 589.7 USD Million by 2035, indicating a robust growth trajectory.

Key Market Trends & Highlights

India Collation Shrink Films Market Key Trends and Highlights

- The market valuation is expected to reach 589.7 USD Million by 2035, reflecting a substantial increase from 322.9 USD Million in 2024.

- The compound annual growth rate (CAGR) for the period from 2025 to 2035 is estimated at 5.63%, suggesting steady growth in demand.

- The growth in the India Collation Shrink Films Market may be driven by the increasing need for efficient packaging solutions across various industries.

- Growing adoption of sustainable packaging solutions due to environmental concerns is a major market driver.

Market Size & Forecast

| 2024 Market Size | 322.9 (USD Million) |

| 2035 Market Size | 589.7 (USD Million) |

| CAGR (2025-2035) | 5.63% |

Major Players

Apex Poly Specialists, Vishakha Industries, Cosmo Films, Jindal Poly Films, Gandhar Oil Refinery, Polybond, Shrinath Polyplast, Axiom International, SRF Limited, Nashik Films, Vishakha Polyfab, BOPP Films India, Wah Sun Holdings, Vevan Packaging, Maharashtra Polybutylene