Government Initiatives and Support

The Indian government is actively promoting the adoption of advanced computing technologies, including cluster computing, through various initiatives and funding programs. The Digital India initiative aims to transform India into a digitally empowered society and knowledge economy, which inherently supports the growth of the cluster computing market. By providing financial incentives and fostering research and development, the government encourages educational institutions and enterprises to invest in cluster computing infrastructure. This support is crucial, as it not only enhances the technological landscape but also stimulates innovation within the cluster computing market. Furthermore, collaborations between government bodies and private sectors are likely to yield advancements in computing technologies, thereby bolstering the overall market growth.

Growth of Cloud Computing Services

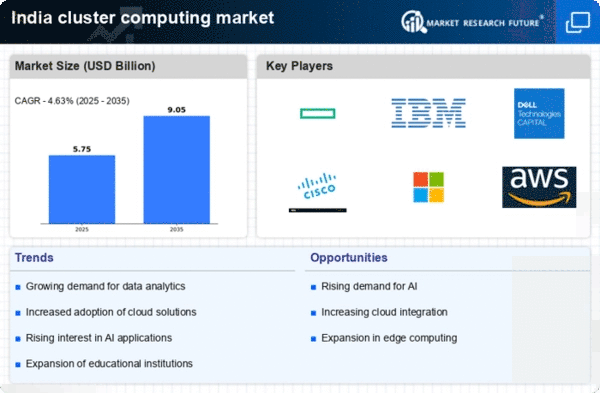

The proliferation of cloud computing services in India is creating new opportunities for the cluster computing market. As businesses increasingly migrate to cloud-based solutions, the integration of cluster computing with cloud services becomes essential. This integration allows organizations to leverage the scalability and flexibility of cloud environments while utilizing the computational power of cluster computing. The cloud computing market in India is projected to grow at a CAGR of over 30% through 2025, indicating a strong trend towards cloud adoption. Consequently, this growth is likely to enhance the demand for cluster computing solutions that can efficiently operate within cloud infrastructures, thereby driving the cluster computing market forward.

Rising Demand for Big Data Analytics

The increasing reliance on data-driven decision-making across various sectors in India is propelling the cluster computing market. Organizations are seeking efficient ways to process and analyze vast amounts of data, which cluster computing facilitates. According to recent estimates, the big data analytics market in India is projected to reach approximately $16 billion by 2025, indicating a robust growth trajectory. This demand for advanced analytics tools necessitates the deployment of cluster computing solutions, as they provide the necessary computational power and scalability. Consequently, businesses are investing in cluster computing technologies to enhance their data processing capabilities, thereby driving growth in the cluster computing market. The ability to handle large datasets efficiently is becoming a critical factor for organizations aiming to maintain a competitive edge in their respective industries.

Increased Focus on Research and Development

The emphasis on research and development (R&D) in various sectors, including academia and industry, is a key driver for the cluster computing market. Institutions in India are investing heavily in R&D to foster innovation and technological advancements. Cluster computing plays a vital role in this context, as it enables researchers to conduct complex simulations and analyses that require substantial computational resources. The allocation of funds for R&D is expected to rise, with the government aiming to increase the overall expenditure on research to 2% of GDP by 2025. This focus on R&D is likely to stimulate the demand for cluster computing solutions, as researchers seek efficient ways to process large datasets and perform intricate calculations, thereby propelling the cluster computing market.

Emergence of Artificial Intelligence and Machine Learning

The rapid advancement of artificial intelligence (AI) and machine learning (ML) technologies is significantly influencing the cluster computing market. As organizations in India increasingly adopt AI and ML applications, the need for powerful computing resources becomes paramount. Cluster computing provides the necessary infrastructure to support complex algorithms and large-scale data processing required for AI and ML tasks. The market for AI in India is expected to reach $7.8 billion by 2025, which suggests a growing reliance on cluster computing solutions to facilitate these technologies. This trend indicates that as AI and ML continue to evolve, the demand for cluster computing resources will likely increase, further driving the growth of the cluster computing market.