Increased Focus on Data Analytics

The cloud database market in India is witnessing a heightened focus on data analytics capabilities. Organizations are increasingly recognizing the value of data-driven decision-making, which necessitates robust database solutions that can support advanced analytics. The integration of analytics tools with cloud databases enables businesses to derive actionable insights from their data, enhancing operational efficiency and competitiveness. It is estimated that the demand for analytics-driven cloud databases will grow by over 25% in the coming years. This trend is particularly relevant in sectors such as retail and healthcare, where data analytics can lead to improved customer experiences and operational efficiencies. As companies continue to invest in data analytics, the cloud database market is likely to benefit from this growing emphasis on leveraging data for strategic advantage.

Rising Demand for Scalable Solutions

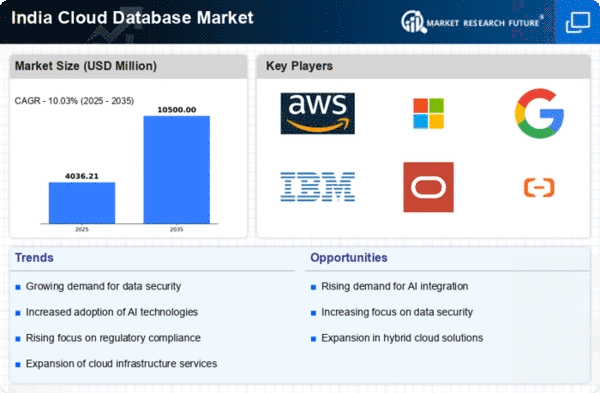

The cloud database market in India is experiencing a notable surge in demand for scalable solutions. As businesses expand, they require databases that can grow alongside their operations. This trend is particularly evident in sectors such as e-commerce and fintech, where data volumes are increasing exponentially. According to recent estimates, the cloud database market is projected to grow at a CAGR of approximately 30% over the next five years. Companies are increasingly opting for cloud databases to manage large datasets efficiently, enabling them to respond swiftly to market changes. This rising demand for scalability is driving innovation and competition among service providers, who are continuously enhancing their offerings to meet the evolving needs of businesses. Consequently, the cloud database market is likely to witness significant growth as organizations prioritize flexible and scalable database solutions.

Shift Towards Cost-Effective Solutions

Cost considerations are becoming a pivotal driver in the cloud database market in India. Organizations are increasingly seeking cost-effective solutions that allow them to optimize their IT budgets. The traditional on-premises database systems often entail substantial upfront investments and ongoing maintenance costs. In contrast, cloud databases offer a pay-as-you-go model, which can lead to significant savings. Reports indicate that businesses can reduce their database management costs by up to 40% by migrating to cloud solutions. This shift towards cost-effective solutions is particularly appealing to small and medium-sized enterprises (SMEs) that may lack the resources for extensive IT infrastructure. As more organizations recognize the financial benefits of cloud databases, the market is expected to expand, driven by the need for affordable and efficient data management options.

Regulatory Compliance and Data Sovereignty

Regulatory compliance is emerging as a critical driver in the cloud database market in India. With the introduction of stringent data protection laws, organizations are compelled to ensure that their data management practices align with legal requirements. This has led to an increased demand for cloud database solutions that offer robust compliance features. Companies are particularly focused on data sovereignty, which mandates that data must be stored within the country. As a result, cloud service providers are adapting their offerings to meet these regulatory demands, thereby enhancing their appeal in the market. It is anticipated that compliance-related features will become a key differentiator among cloud database providers, influencing purchasing decisions. Consequently, the cloud database market is likely to expand as organizations prioritize compliance and data sovereignty in their database management strategies.

Growing Adoption of Internet of Things (IoT)

The proliferation of Internet of Things (IoT) devices is significantly impacting the cloud database market in India. As more devices become interconnected, the volume of data generated is increasing at an unprecedented rate. This surge in data necessitates efficient storage and management solutions, which cloud databases are well-positioned to provide. Industries such as manufacturing and agriculture are leveraging IoT technologies to enhance operational efficiencies, leading to a growing reliance on cloud databases for real-time data processing and analytics. It is projected that the integration of IoT with cloud databases will drive market growth by approximately 20% over the next few years. As organizations seek to harness the potential of IoT, the demand for cloud database solutions that can handle large-scale data influxes is expected to rise, further propelling the market forward.