Expansion of Internet Connectivity

The expansion of internet connectivity across India plays a crucial role in the growth of the cloud analytics market. With the increasing penetration of high-speed internet, more businesses are able to leverage cloud-based analytics solutions. This trend is particularly pronounced in rural and semi-urban areas, where improved connectivity enables small and medium enterprises to access advanced analytics tools that were previously out of reach. As of 2025, it is estimated that internet penetration in India has reached approximately 70%, facilitating a broader adoption of cloud analytics solutions. This enhanced connectivity not only supports data-driven decision-making but also fosters innovation within the cloud analytics market.

Rising Demand for Real-Time Analytics

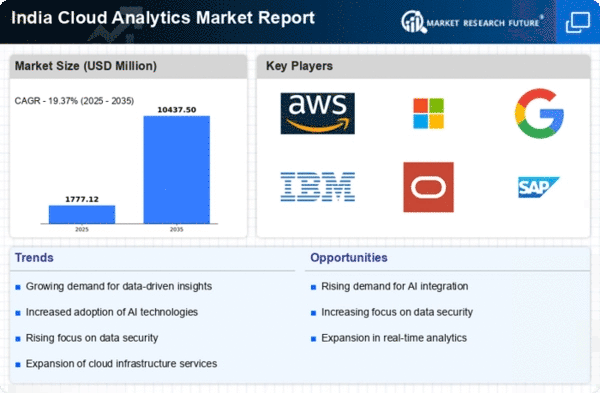

The cloud analytics market in India experiences a notable surge in demand for real-time analytics solutions. Businesses increasingly recognize the necessity of immediate data insights to enhance decision-making processes. This trend is particularly evident in sectors such as retail and finance, where timely information can significantly impact operational efficiency and customer satisfaction. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 30% over the next five years. This growth is likely driven by the need for organizations to respond swiftly to market changes and consumer behavior, thereby solidifying the importance of real-time analytics within the cloud analytics market.

Emergence of Advanced Analytical Tools

The emergence of advanced analytical tools is reshaping the landscape of the cloud analytics market in India. Innovations in artificial intelligence and machine learning are driving the development of sophisticated analytics solutions that offer deeper insights and predictive capabilities. As organizations increasingly adopt these advanced tools, the demand for cloud-based analytics solutions is expected to rise. Market analysts project that the adoption of AI-driven analytics tools could increase by over 40% in the next few years. This trend indicates a shift towards more complex analytical processes, thereby enhancing the overall value proposition of the cloud analytics market.

Increased Focus on Data-Driven Decision Making

The increasing focus on data-driven decision making among Indian enterprises is a pivotal driver for the cloud analytics market. Organizations are progressively recognizing the value of data as a strategic asset, leading to a surge in investments in analytics solutions. A recent survey indicates that approximately 65% of businesses in India are prioritizing data analytics to enhance their competitive edge. This trend is likely to continue as companies seek to harness insights from vast amounts of data generated daily. The emphasis on data-driven strategies not only enhances operational efficiency but also positions the cloud analytics market as a vital component of modern business practices.

Government Initiatives for Digital Transformation

Government initiatives aimed at promoting digital transformation significantly influence the cloud analytics market in India. Programs such as Digital India encourage businesses to adopt cloud technologies, thereby enhancing their analytical capabilities. The government has allocated substantial funding to support technology adoption, which is expected to reach around $1 billion by 2026. This financial backing is likely to stimulate growth in the cloud analytics market, as organizations are incentivized to invest in cloud-based solutions that improve operational efficiency and data management. Consequently, the alignment of government policies with technological advancements appears to create a conducive environment for the expansion of the cloud analytics market.