Public Awareness and Education

Public awareness regarding climate change and its impacts has been steadily increasing in India, which is influencing the carbon capture-storage market. Educational campaigns and initiatives by non-governmental organizations have played a crucial role in informing the public about the benefits of carbon capture technologies. As awareness grows, there is a corresponding increase in demand for cleaner technologies, prompting industries to adopt carbon capture solutions. Surveys indicate that approximately 70% of the population supports government initiatives aimed at reducing carbon emissions, which could lead to greater acceptance and implementation of carbon capture technologies. This heightened public interest is likely to create a favorable environment for investments in the carbon capture-storage market.

Regulatory Framework Enhancements

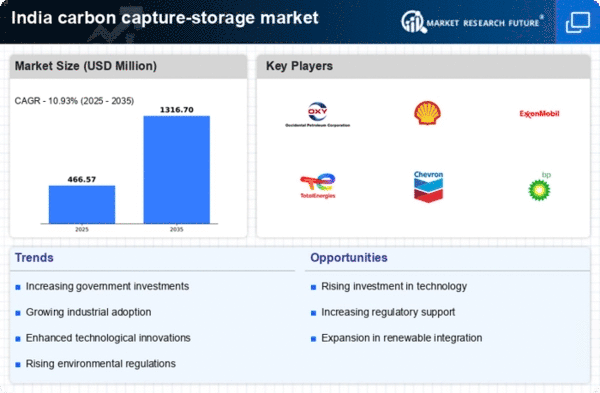

The evolving regulatory framework in India plays a pivotal role in shaping the carbon capture-storage market. The government has been actively formulating policies aimed at reducing greenhouse gas emissions, which has led to a more structured approach towards carbon management. For instance, the Ministry of Environment, Forest and Climate Change has introduced guidelines that encourage industries to adopt carbon capture technologies. This regulatory push is expected to drive investments in the carbon capture-storage market, with projections indicating a potential market growth of 20% annually over the next five years. Furthermore, compliance with international climate agreements necessitates the adoption of such technologies, thereby reinforcing the importance of a robust regulatory environment in fostering market growth.

Corporate Sustainability Commitments

In recent years, Indian corporations have increasingly recognized the importance of sustainability, which has a direct impact on the carbon capture-storage market. Many companies are setting ambitious targets to achieve net-zero emissions by 2050, prompting them to invest in carbon capture technologies. This trend is particularly evident in sectors such as energy, cement, and steel, which are among the largest emitters of CO2. As of 2025, it is estimated that corporate investments in carbon capture initiatives could reach $1 billion, significantly contributing to the overall market. The alignment of corporate strategies with environmental goals not only enhances brand reputation but also positions companies favorably in a competitive landscape, thereby driving demand for carbon capture-storage solutions.

International Collaboration and Funding

International collaboration is emerging as a significant driver for the carbon capture-storage market in India. Various global partnerships are being formed to share knowledge, technology, and funding for carbon capture projects. For instance, collaborations with countries that have advanced carbon capture technologies can facilitate technology transfer and capacity building. Additionally, international funding from organizations such as the World Bank and the Asian Development Bank is increasingly being directed towards carbon capture initiatives in India. This influx of financial resources is expected to bolster the market, with estimates suggesting that international funding could account for up to 30% of total investments in the carbon capture-storage market by 2027. Such collaborations not only enhance technological capabilities but also promote sustainable development goals.

Economic Incentives and Financial Mechanisms

Economic incentives and financial mechanisms are crucial in promoting the carbon capture-storage market in India. The government has introduced various financial instruments, such as tax credits and grants, to encourage industries to invest in carbon capture technologies. These incentives are designed to offset the high initial costs associated with implementing carbon capture systems, making them more attractive to businesses. As of 2025, it is projected that these financial mechanisms could lead to a 15% increase in market participation from the industrial sector. Furthermore, the establishment of carbon pricing mechanisms may create additional economic motivations for companies to adopt carbon capture solutions, thereby enhancing the overall growth trajectory of the carbon capture-storage market.