Focus on Digital Transformation

The emphasis on digital transformation is a significant driver of the India business process management market. Organizations across various sectors are recognizing the necessity of digitizing their processes to enhance efficiency and customer engagement. The Indian government has also been promoting digital initiatives, such as Digital India, which encourages businesses to adopt digital technologies. This initiative has led to an increase in investments in BPM solutions that facilitate digital workflows and improve service delivery. As companies strive to align with digital trends, the demand for BPM services is expected to rise, further fueling the growth of the India business process management market.

Growing Demand for Cost Efficiency

The India business process management market is witnessing a growing demand for cost efficiency among organizations. Companies are increasingly seeking to optimize their operations and reduce overhead costs. This trend is driven by the need to remain competitive in a rapidly evolving market. According to recent data, businesses that have adopted BPM solutions have reported a reduction in operational costs by up to 30 percent. This cost-saving potential is particularly appealing to small and medium enterprises (SMEs) in India, which constitute a significant portion of the economy. As these organizations strive to enhance their profitability, the adoption of BPM solutions is likely to accelerate, thereby propelling the growth of the India business process management market.

Rising Importance of Data Security

In the context of the India business process management market, data security has emerged as a critical concern for organizations. With the increasing digitization of processes, the risk of data breaches and cyber threats has escalated. Consequently, businesses are prioritizing the implementation of BPM solutions that offer robust security features. Regulatory frameworks, such as the Personal Data Protection Bill, are also influencing organizations to adopt secure BPM practices. As companies seek to protect sensitive information and comply with regulations, the demand for secure BPM solutions is likely to grow. This trend underscores the importance of data security in driving the evolution of the India business process management market.

Technological Advancements in BPM Solutions

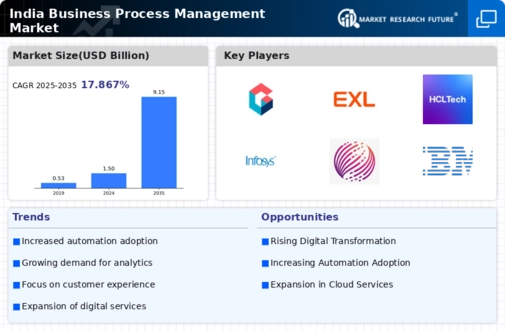

Technological advancements are playing a pivotal role in shaping the India business process management market. The integration of artificial intelligence, machine learning, and cloud computing into BPM solutions is enhancing their capabilities. These technologies enable organizations to automate complex processes, improve decision-making, and enhance data analytics. For instance, the use of AI-driven analytics allows businesses to gain insights into customer behavior and operational efficiency. As a result, organizations are increasingly investing in advanced BPM solutions to leverage these technologies. The market for BPM software in India is projected to grow at a compound annual growth rate (CAGR) of approximately 12 percent over the next five years, indicating a robust demand for innovative BPM solutions.

Enhanced Focus on Customer-Centric Strategies

The India business process management market is increasingly characterized by a focus on customer-centric strategies. Organizations are recognizing that enhancing customer experience is paramount to achieving long-term success. As a result, businesses are leveraging BPM solutions to streamline customer interactions and improve service delivery. The ability to analyze customer feedback and adapt processes accordingly is becoming essential. Companies that implement BPM solutions report higher customer satisfaction rates and improved retention. This shift towards customer-centricity is expected to drive further investments in BPM technologies, thereby contributing to the growth of the India business process management market.