Regulatory Changes

the India bunker fuel market is currently experiencing a transformation due to evolving regulatory frameworks. The Indian government has been implementing stricter environmental regulations aimed at reducing emissions from ships. For instance, the introduction of the International Maritime Organization's (IMO) 2020 sulfur cap has prompted Indian ports to adapt their bunker fuel offerings. This regulatory shift is likely to drive demand for low-sulfur fuel oil (LSFO) and other compliant fuels. As a result, the industry is witnessing an increase in investments in infrastructure to support the supply of cleaner fuels. Furthermore, the government's commitment to achieving net-zero emissions by 2070 may lead to further regulatory changes, influencing the bunker fuel market dynamics in India.

Increased Competition

Increased competition within the India bunker fuel market is emerging as a significant driver of change. With the entry of new players and the expansion of existing suppliers, the market is becoming more dynamic. This heightened competition is likely to lead to more competitive pricing and improved service offerings for shipping companies. Additionally, established players are investing in enhancing their supply chain capabilities to maintain their market share. The Indian government’s initiatives to promote ease of doing business in the maritime sector are further encouraging new entrants. As competition intensifies, it may also spur innovation in fuel offerings, including the development of cleaner and more efficient bunker fuels, aligning with global sustainability goals.

Growth in Shipping Sector

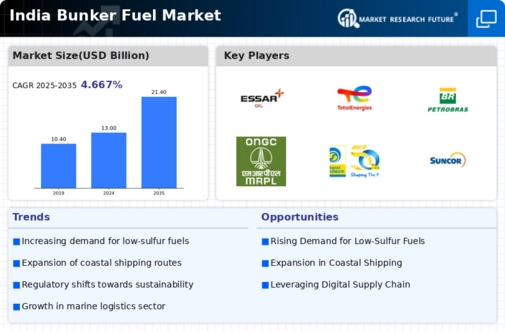

The growth trajectory of the shipping sector in India is a pivotal driver for the bunker fuel market. With the increasing volume of trade and the expansion of the maritime sector, the demand for bunker fuel is expected to rise significantly. According to the Ministry of Shipping, India's cargo traffic is projected to reach 2.5 billion tonnes by 2030, which will necessitate a corresponding increase in bunker fuel supply. Additionally, the government's initiatives to enhance port infrastructure and promote coastal shipping are likely to further stimulate the demand for bunker fuel. This growth in the shipping sector not only supports the bunker fuel market but also encourages investments in cleaner fuel alternatives, aligning with global sustainability trends.

Focus on Alternative Fuels

the India bunker fuel market is witnessing a notable shift towards alternative fuels, driven by environmental concerns and regulatory pressures. The Indian government has been actively promoting the use of biofuels and LNG (liquefied natural gas) as viable alternatives to traditional bunker fuels. This focus on alternative fuels is expected to reshape the market landscape, as shipping companies seek to comply with stringent emission regulations. The Ministry of Petroleum and Natural Gas has initiated programs to explore the feasibility of biofuels in maritime applications, which could potentially reduce the carbon footprint of the shipping industry. As the demand for cleaner fuels increases, the bunker fuel market in India may see a diversification of fuel offerings, catering to the evolving needs of the shipping sector.

Technological Advancements

Technological advancements are playing a crucial role in shaping the India bunker fuel market. Innovations in fuel management systems, such as real-time monitoring and analytics, are enhancing operational efficiency for shipping companies. These technologies enable better fuel consumption tracking and optimization, which can lead to cost savings and reduced emissions. Furthermore, the adoption of scrubber technology by some vessels allows them to continue using high-sulfur fuel oil while complying with emission regulations. As these technologies become more prevalent, they are likely to influence the demand for specific types of bunker fuels in India. The integration of advanced technologies in the shipping sector may also drive investments in research and development, fostering a more sustainable bunker fuel market.