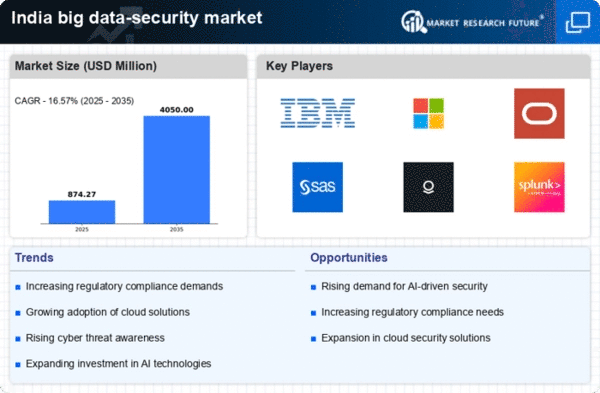

Increased Cloud Adoption

The rapid adoption of cloud computing in India is significantly impacting the big data-security market. As businesses migrate their operations to the cloud, they face new security challenges that necessitate advanced protective measures. The cloud environment, while offering scalability and flexibility, also presents vulnerabilities that can be exploited by cybercriminals. Consequently, organizations are increasingly seeking security solutions tailored for cloud infrastructures. The big data-security market is projected to expand as companies invest in cloud security technologies to safeguard their data in these environments. This trend indicates a growing recognition of the importance of securing cloud-based data assets, which is likely to drive innovation in security solutions.

Growing Regulatory Frameworks

The evolving regulatory landscape in India is a crucial driver for the big data-security market. With the introduction of stringent data protection laws, organizations are compelled to comply with regulations that mandate the safeguarding of personal and sensitive data. The Personal Data Protection Bill, for instance, emphasizes the need for robust security measures, which has led to an increased focus on data security solutions. As businesses strive to meet compliance requirements, the big data-security market is likely to experience substantial growth. Companies are investing in security technologies to ensure adherence to these regulations, thereby enhancing their overall data protection strategies and fostering trust among consumers.

Digital Transformation Initiatives

India's ongoing digital transformation initiatives are significantly influencing the big data-security market. As organizations increasingly adopt digital technologies, the volume of data generated is expanding exponentially. This surge in data necessitates enhanced security measures to protect against unauthorized access and data leaks. The Indian government has been promoting digitalization across various sectors, which has led to a projected growth of the big data-security market by approximately 25% over the next five years. Companies are now recognizing the importance of integrating security into their digital strategies, thereby driving demand for comprehensive security solutions that can effectively manage and protect large datasets.

Emergence of Advanced Analytics and AI

The emergence of advanced analytics and artificial intelligence (AI) technologies is reshaping the big data-security market in India. Organizations are leveraging AI-driven security solutions to enhance their threat detection and response capabilities. These technologies enable businesses to analyze vast amounts of data in real-time, identifying potential security threats more efficiently. As AI continues to evolve, its integration into security frameworks is expected to become more prevalent. The big data-security market is likely to benefit from this trend, as companies seek to adopt innovative solutions that can proactively address security challenges. This shift towards AI-driven security measures may lead to a more resilient data protection landscape in India.

Rising Data Breaches and Cyber Threats

The increasing frequency of data breaches and cyber threats in India is a primary driver for the big data-security market. Organizations are facing a surge in sophisticated cyber-attacks, which has led to a heightened awareness of the need for robust security measures. According to recent reports, the number of data breaches in India has escalated by over 30% in the past year alone. This alarming trend compels businesses to invest in advanced security solutions to protect sensitive information. The big data-security market is expected to grow as companies prioritize safeguarding their data assets against potential threats. As a result, the demand for innovative security technologies and services is likely to rise, further propelling market growth.