Increased Focus on Data Sovereignty

Data sovereignty has emerged as a crucial concern for Indian enterprises, particularly in light of stringent data protection regulations. The bare metal-cloud market is experiencing growth as organizations seek to ensure that their data remains within national borders. This focus on compliance with local laws is driving the demand for dedicated infrastructure that can guarantee data residency. As per recent studies, approximately 70% of Indian companies are prioritizing data sovereignty in their cloud strategies. This trend is likely to continue, as businesses recognize the importance of maintaining control over their data. Consequently, the bare metal-cloud market is positioned to benefit from this heightened emphasis on data governance, as it offers tailored solutions that meet regulatory requirements while providing the performance and reliability that enterprises demand.

Emergence of Edge Computing Solutions

The rise of edge computing is significantly influencing the bare metal-cloud market in India. As organizations increasingly adopt IoT devices and applications, the need for low-latency processing and real-time data analysis becomes paramount. Edge computing solutions, which process data closer to the source, are gaining traction, and bare metal-cloud infrastructure is well-suited to support these requirements. The market for edge computing in India is expected to grow at a CAGR of 30% over the next few years. This growth is likely to drive demand for bare metal-cloud services that can provide the necessary computational power and storage capabilities at the edge. By leveraging bare metal-cloud solutions, businesses can enhance their operational efficiency and responsiveness, thereby positioning themselves favorably in a competitive landscape.

Rising Investment in Digital Transformation

Indian enterprises are increasingly investing in digital transformation initiatives, which is positively impacting the bare metal-cloud market. As organizations strive to modernize their IT infrastructure, they are turning to bare metal-cloud solutions for their ability to deliver high performance and customization. Reports indicate that the digital transformation market in India is projected to reach $100 billion by 2025, with a significant portion allocated to cloud services. This investment trend suggests that businesses are recognizing the value of bare metal-cloud offerings in achieving their transformation goals. By adopting these solutions, companies can enhance their agility, reduce operational costs, and improve service delivery, thereby driving further growth in the bare metal-cloud market.

Growing Adoption of Cloud-Native Applications

The increasing adoption of cloud-native applications in India is driving the bare metal-cloud market. Organizations are seeking to leverage the scalability and flexibility offered by cloud-native architectures. This trend is particularly evident in sectors such as e-commerce and fintech, where rapid deployment and performance optimization are critical. According to industry reports, the cloud-native application market in India is projected to grow at a CAGR of 25% over the next five years. As businesses transition to these applications, the demand for bare metal-cloud solutions, which provide dedicated resources and enhanced performance, is likely to rise. This shift not only enhances operational efficiency but also aligns with the broader digital transformation initiatives across various industries, thereby propelling the bare metal-cloud market forward.

Competitive Landscape and Service Differentiation

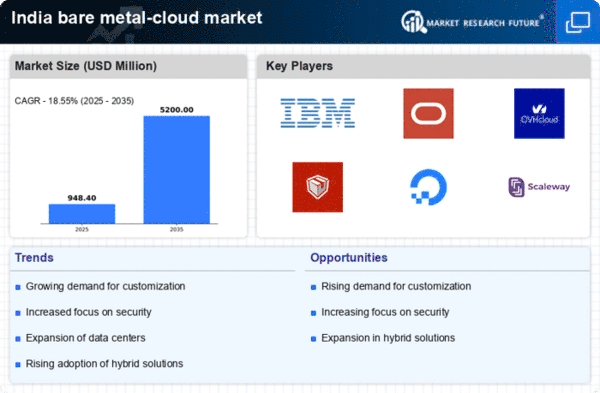

The competitive landscape in the Indian bare metal-cloud market is evolving, with numerous players striving to differentiate their services. As the market matures, providers are increasingly focusing on offering unique features such as enhanced security, superior performance, and tailored solutions. This competitive pressure is likely to drive innovation and improve service quality across the sector. According to market analysis, the number of bare metal-cloud service providers in India has increased by 40% in the last two years. This influx of competition is beneficial for consumers, as it leads to more options and potentially lower prices. As companies seek to gain a competitive edge, the emphasis on service differentiation will likely continue to shape the dynamics of the bare metal-cloud market.