Emphasis on Real-Time Analytics

The emphasis on real-time analytics is a significant driver for the augmented analytics market in India. Organizations are increasingly seeking solutions that provide immediate insights, enabling them to make timely decisions. This demand is particularly evident in sectors such as e-commerce and finance, where rapid decision-making is crucial. The market for real-time analytics is anticipated to grow substantially, with projections indicating a potential increase of over 40% in the next few years. As businesses strive to enhance their responsiveness to market dynamics, The augmented analytics market is likely to flourish, offering tools that facilitate real-time data processing and visualization. This shift towards real-time analytics underscores the importance of agility in today’s fast-paced business environment.

Integration of Advanced Technologies

The integration of advanced technologies, such as machine learning and natural language processing, is propelling the augmented analytics market in India. These technologies enhance the capabilities of analytics tools, allowing users to derive insights without extensive technical expertise. As organizations seek to democratize data access, the demand for user-friendly analytics solutions is on the rise. Reports indicate that the market for augmented analytics tools is expected to reach $1 billion by 2026, driven by the increasing adoption of AI-driven analytics platforms. This trend suggests that businesses are prioritizing tools that simplify data analysis, enabling employees at all levels to make informed decisions. Consequently, the augmented analytics market is likely to witness robust growth as companies invest in these advanced technologies to improve operational efficiency.

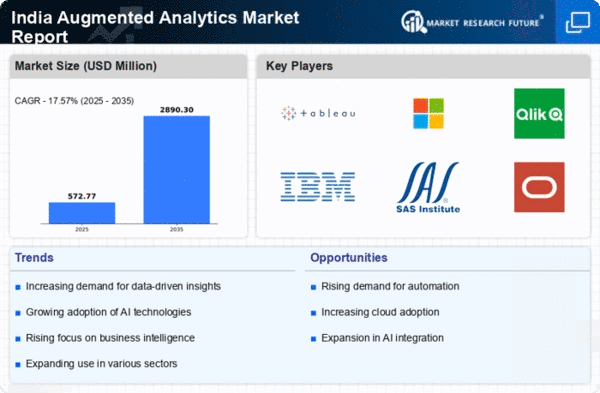

Growing Focus on Business Intelligence

The augmented analytics market in India is benefiting from a growing focus on business intelligence (BI) solutions. Organizations are increasingly investing in BI tools to enhance their analytical capabilities and improve decision-making processes. The market for BI solutions is projected to grow at a CAGR of around 25% in the coming years, indicating a strong demand for integrated analytics platforms. This trend is driven by the need for organizations to harness data from various sources and transform it into actionable insights. As businesses recognize the importance of data in driving competitive advantage, the augmented analytics market is likely to expand, providing innovative solutions that cater to the evolving needs of enterprises. The integration of BI with augmented analytics is expected to create a more comprehensive approach to data analysis.

Rising Demand for Data-Driven Decision Making

The augmented analytics market in India is experiencing a surge in demand as organizations increasingly recognize the value of data-driven decision making. Businesses are leveraging advanced analytics to gain insights that drive strategic initiatives. According to recent estimates, the market is projected to grow at a CAGR of approximately 30% over the next five years. This growth is fueled by the need for real-time analytics and actionable insights, enabling companies to respond swiftly to market changes. As organizations across various sectors, including finance, retail, and healthcare, adopt data-centric approaches, the augmented analytics market is likely to expand significantly. The emphasis on data-driven strategies is reshaping how businesses operate, making augmented analytics an essential component of their digital transformation journeys.

Increased Investment in Digital Transformation

The augmented analytics market in India is witnessing increased investment in digital transformation initiatives. Organizations are recognizing the need to modernize their data infrastructure and analytics capabilities to remain competitive. This trend is reflected in the growing budgets allocated for technology adoption, with many companies planning to invest over 20% of their IT budgets in analytics solutions. As businesses embark on their digital transformation journeys, the demand for augmented analytics tools is expected to rise. These tools enable organizations to leverage their data assets effectively, driving innovation and operational efficiency. The focus on digital transformation is likely to propel the augmented analytics market forward, as companies seek to harness the power of data to achieve their strategic objectives.