Government Initiatives and Policies

Government initiatives aimed at enhancing digital infrastructure play a crucial role in driving the 5g fixed-wireless-access market. The Indian government has launched various programs to promote digital inclusion, such as the Digital India initiative, which seeks to provide internet access to rural and remote areas. These policies are designed to encourage private sector investment in telecommunications infrastructure, thereby facilitating the deployment of 5g fixed-wireless-access technologies. Furthermore, the government's focus on improving broadband penetration is expected to create a favorable regulatory environment for service providers. As a result, the 5g fixed-wireless-access market is likely to benefit from increased funding and support, enabling faster rollout and adoption of advanced connectivity solutions across the country.

Rising Demand for High-Speed Internet

The increasing demand for high-speed internet access in India is a primary driver for the 5G Fixed-Wireless-Access Market. As more individuals and businesses seek reliable connectivity, the need for faster data transmission becomes critical. Reports indicate that the number of internet users in India has surpassed 800 million, with a significant portion relying on mobile and fixed broadband services. This surge in demand is likely to propel investments in 5g fixed-wireless-access solutions, as they offer a viable alternative to traditional wired connections. The ability to deliver high-speed internet to underserved areas further enhances the appeal of this technology, potentially leading to a more inclusive digital economy. Consequently, the 5g fixed-wireless-access market is poised for substantial growth as service providers strive to meet the evolving needs of consumers and enterprises alike.

Shift Towards Remote Work and Learning

The shift towards remote work and online learning has created a heightened demand for reliable internet connectivity, thereby driving the 5g fixed-wireless-access market. As organizations and educational institutions increasingly adopt digital platforms, the need for high-speed internet has become paramount. This trend is particularly evident in urban areas, where the demand for seamless connectivity is critical for productivity and engagement. Moreover, the rise of hybrid work models suggests that this demand is likely to persist in the long term. Consequently, service providers are focusing on expanding their 5g fixed-wireless-access offerings to cater to this evolving landscape, ensuring that users have access to the necessary bandwidth for video conferencing, online collaboration, and other data-intensive applications.

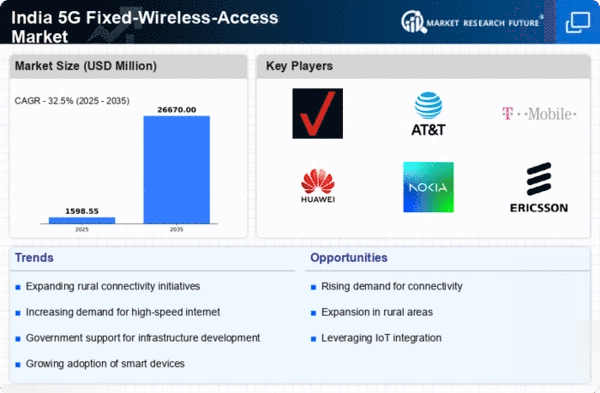

Competitive Landscape and Market Entry Opportunities

The competitive landscape of the telecommunications sector in India is evolving, presenting new opportunities for the 5g fixed-wireless-access market. With several players vying for market share, there is a strong impetus for innovation and differentiation among service providers. New entrants are exploring niche markets and underserved regions, aiming to capture a portion of the growing demand for high-speed internet. Additionally, partnerships between technology companies and telecom operators are becoming more common, facilitating the development and deployment of advanced fixed-wireless-access solutions. This competitive environment is likely to drive down prices and improve service quality, ultimately benefiting consumers. As a result, the 5g fixed-wireless-access market is expected to witness robust growth as companies strive to establish a foothold in this dynamic sector.

Technological Advancements in Wireless Communication

Technological advancements in wireless communication are significantly influencing the 5g fixed-wireless-access market. Innovations in antenna technology, spectrum efficiency, and network management are enhancing the performance and reliability of fixed-wireless-access solutions. For instance, the development of Massive MIMO (Multiple Input Multiple Output) technology allows for improved signal quality and capacity, which is essential for meeting the growing data demands of users. Additionally, advancements in network slicing enable service providers to offer tailored connectivity solutions for various applications, from residential to industrial use. These technological improvements not only enhance user experience but also reduce operational costs for service providers, making the 5g fixed-wireless-access market an attractive proposition for investment and growth in India.