Emergence of Smart Cities

The emergence of smart cities in India is significantly influencing the 5G Customer-Premises-Equipment Market. As urban areas evolve into smart cities, the demand for advanced communication technologies rises. These cities require efficient data management, real-time monitoring, and seamless connectivity, all of which are facilitated by 5G technology. Reports indicate that the smart city initiative could lead to investments exceeding $30 billion by 2025, creating a substantial market for customer-premises equipment. This trend suggests that as cities adopt smart technologies, the need for sophisticated equipment will likely increase, driving market growth and innovation.

Growth of IoT Applications

The rapid growth of Internet of Things (IoT) applications in India is a significant driver for the 5G Customer-Premises-Equipment Market. With the increasing integration of IoT devices across various sectors, including healthcare, agriculture, and manufacturing, the demand for high-speed and low-latency connectivity is paramount. It is estimated that the number of IoT devices in India could reach 1.9 billion by 2025, necessitating advanced customer-premises equipment to support this ecosystem. This surge in IoT adoption indicates a robust market potential for 5G technologies, as they provide the necessary infrastructure to enable seamless communication between devices.

Rising Demand for High-Speed Internet

The increasing demand for high-speed internet connectivity in India is a primary driver for the 5G Customer-Premises-Equipment Market. As more consumers and businesses seek reliable and fast internet services, the need for advanced customer-premises equipment becomes evident. According to recent data, approximately 70% of urban households are expected to adopt 5G services by 2026, which will significantly boost the market. This trend is further fueled by the proliferation of online services, including streaming, gaming, and remote work solutions, which require robust internet infrastructure. Consequently, manufacturers are focusing on developing innovative equipment to meet this growing demand, thereby enhancing the overall market landscape.

Government Initiatives and Investments

Government initiatives aimed at enhancing digital infrastructure in India play a crucial role in driving the 5G Customer-Premises-Equipment Market. The Indian government has launched various programs to promote digital inclusion and improve connectivity in rural and urban areas. For instance, the National Digital Communications Policy aims to attract investments of over $100 billion in the telecom sector by 2025. Such initiatives not only encourage the deployment of 5G technology but also stimulate the demand for customer-premises equipment. As a result, stakeholders in the market are likely to benefit from increased funding and support, which could lead to accelerated growth and innovation in the sector.

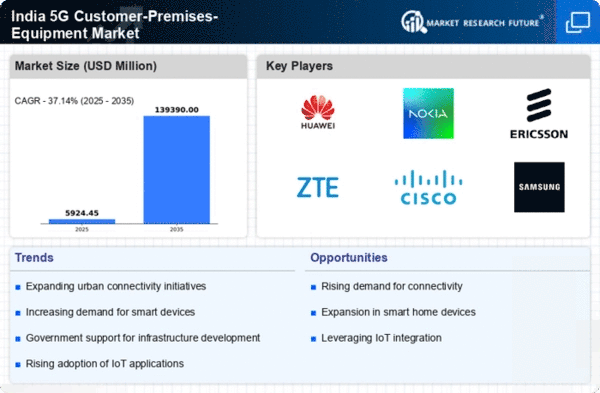

Competitive Landscape and Technological Advancements

The competitive landscape within the 5G Customer-Premises-Equipment Market is characterized by rapid technological advancements and innovation. As various players strive to capture market share, they are investing heavily in research and development to create cutting-edge equipment. This competitive environment fosters the introduction of new features and capabilities, enhancing the overall user experience. Additionally, partnerships and collaborations among technology firms are likely to accelerate the development of next-generation equipment. As a result, the market is expected to witness continuous evolution, driven by the need for improved performance and efficiency in customer-premises equipment.