Top Industry Leaders in the In-wheel Motors Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

November 2023- GM has filed a patent for a system that will be able to detect and monitor vibrations in a vehicle's wheels and tires. The new General Motors patent application has been assigned patent number US 11,815,426 B2 with the United States Patent and Trademark Office (USPTO) and was published on November 14th, 2023. The patent was originally filed on October 16th, 2020, and lists several Canadian-based engineers as the inventors, including Anushya Viraliur Ponnuswami, Joseph K. Moore, Halit Zengin, Eungkil Lee, and Mansoor Alghooneh. The patent describes a system that incorporates a plurality of encoders and an analyzer, with the encoders providing multiple pulse train signals from multiple vehicle wheels. As each encoder provides pulse signals to the analyzer, the analyzer generates multiple pulses per revolution signals and angular velocity signals in response. The analyzer also incorporates an input phasor array representative of the pulse per revolution signals, which enables the generation of a report that can identify at least one vibrating wheel and tire in the system. As the patent points out, vibrations are a common occurrence in motor vehicles, and wheels and tires can vibrate with each rotation. This periodic vibration can result from manufacturing defects, normal wear on the tires, irregular tire thickness, or other possible reasons. As such, a system capable of monitoring tire and wheel vibrations would prove to be useful. Although the patent does not mention autonomous vehicles (AVs) specifically, it's conceivable that this system could prove particularly useful in applications where there is no human pilot to monitor the vehicle status, such as long-haul autonomous trucking or autonomous ride-hailing services.

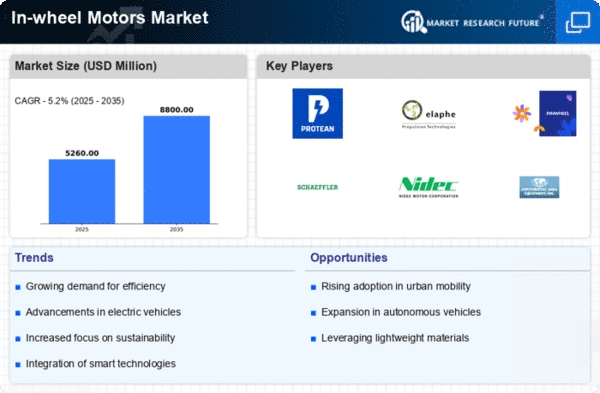

Top listed global companies in the industry are:

- Protean Electric (US)

- NTN (Japan)

- NSK (Japan)

- Printed Motor Works (UK)

- Elaphe Ltd. (Slovenia)

- Ziehl-Abegg (Germany)

- e-Traction (Netherlands)

- DANA TM4 (Canada)

- Ecomove (Denmark)

- TAJIMA EV (Japan)

- YASA (UK)

- Schaeffler (Germany), and others.