Rising Environmental Awareness

Growing environmental awareness among consumers is a key driver for the US In Wheel Motors Market. As concerns about climate change and air pollution intensify, more consumers are seeking sustainable transportation options. In wheel motors, which contribute to the overall efficiency of electric vehicles, are increasingly viewed as a viable solution to reduce carbon footprints. Market Research Future indicates that nearly 70% of consumers are willing to pay a premium for environmentally friendly vehicles. This shift in consumer preferences is prompting automakers to invest in wheel motor technology, thereby expanding the market. The increasing demand for sustainable solutions is likely to propel the growth of the in wheel motors market in the coming years.

Government Incentives and Policies

The US In Wheel Motors Market benefits significantly from government incentives and policies aimed at promoting electric mobility. Federal and state governments are increasingly offering tax credits, rebates, and grants to manufacturers and consumers who invest in electric vehicles equipped with in wheel motors. For example, the federal tax credit for electric vehicles can reach up to $7,500, encouraging consumers to opt for electric models. Additionally, various states have implemented their own incentives, further stimulating demand. This supportive regulatory environment is expected to bolster the market, as it not only reduces the initial cost barrier for consumers but also encourages manufacturers to innovate and expand their offerings in the in wheel motors segment.

Technological Innovations in Wheel Motors

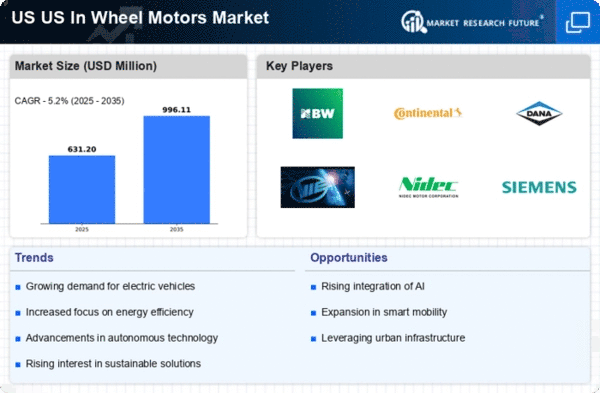

The US In Wheel Motors Market is experiencing a surge in technological innovations that enhance the performance and efficiency of electric vehicles. Advances in battery technology, coupled with improvements in motor design, are leading to lighter and more compact in wheel motors. These innovations not only increase the range of electric vehicles but also improve their overall driving dynamics. For instance, the integration of regenerative braking systems within wheel motors allows for energy recovery during deceleration, which is particularly appealing to manufacturers aiming to meet stringent efficiency standards. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years, driven by these technological advancements.

Enhanced Vehicle Performance and Design Flexibility

The US In Wheel Motors Market is also driven by the enhanced vehicle performance and design flexibility that in wheel motors provide. By integrating the motor directly into the wheel, manufacturers can achieve a more compact design, allowing for greater interior space and improved aerodynamics. This design flexibility enables automakers to create lighter vehicles with better handling characteristics. Furthermore, in wheel motors facilitate independent wheel control, which can enhance traction and stability, particularly in adverse weather conditions. As performance becomes a critical factor for consumers, the demand for vehicles equipped with in wheel motors is expected to rise, contributing to the overall growth of the market.

Increased Investment in Electric Vehicle Infrastructure

Investment in electric vehicle infrastructure is a crucial driver for the US In Wheel Motors Market. The expansion of charging networks and support facilities is essential for the widespread adoption of electric vehicles. As more charging stations become available, consumer confidence in electric vehicles, including those with in wheel motors, is likely to increase. Recent reports indicate that the US government plans to invest over $7 billion in electric vehicle infrastructure over the next five years. This investment not only supports the growth of the electric vehicle market but also creates a favorable environment for in wheel motor technology to thrive. As infrastructure improves, the market for in wheel motors is expected to expand significantly.