Advancements in Telematics Solutions

Telematics solutions are playing a pivotal role in the evolution of the In-Vehicle Connectivity Market. These systems enable real-time data transmission between vehicles and external networks, enhancing functionalities such as fleet management, vehicle tracking, and predictive maintenance. The telematics segment is projected to grow at a compound annual growth rate of approximately 15% through 2025, reflecting the increasing adoption of these technologies by both consumers and businesses. As telematics solutions become more sophisticated, they are likely to offer improved safety features, such as emergency response services and driver behavior monitoring, thereby driving further growth in the In-Vehicle Connectivity Market.

Government Regulations and Standards

Government regulations and standards are increasingly shaping the In-Vehicle Connectivity Market. Authorities worldwide are implementing stringent guidelines aimed at enhancing vehicle safety and reducing emissions, which often necessitate the incorporation of advanced connectivity features. For instance, regulations mandating vehicle-to-everything (V2X) communication are becoming more prevalent, as they are believed to improve traffic management and reduce accidents. By 2025, it is expected that compliance with these regulations will drive a significant portion of the market growth, as manufacturers invest in technologies that not only meet regulatory requirements but also enhance the overall driving experience. This regulatory landscape is likely to create both challenges and opportunities within the In-Vehicle Connectivity Market.

Rising Adoption of Electric Vehicles

The transition towards electric vehicles (EVs) is significantly influencing the In-Vehicle Connectivity Market. As more consumers opt for EVs, the demand for advanced connectivity features that enhance the driving experience is expected to rise. By 2025, it is anticipated that electric vehicles will account for nearly 30% of total vehicle sales, necessitating the integration of connectivity solutions that support charging station locators, battery management systems, and energy consumption monitoring. This shift not only promotes sustainability but also encourages manufacturers to innovate within the In-Vehicle Connectivity Market, as they seek to provide consumers with a comprehensive suite of connected services tailored to the unique needs of EV users.

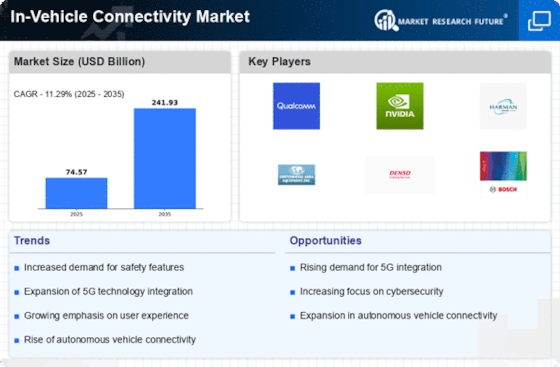

Increasing Demand for Connected Vehicles

The In-Vehicle Connectivity Market is experiencing a surge in demand for connected vehicles, driven by consumer preferences for enhanced convenience and safety features. As of 2025, it is estimated that over 70% of new vehicles will be equipped with some form of connectivity. This trend is largely influenced by the growing reliance on mobile applications and services that facilitate navigation, entertainment, and vehicle diagnostics. Furthermore, the integration of connectivity features is becoming a key differentiator for automotive manufacturers, as consumers increasingly seek vehicles that offer seamless integration with their digital lifestyles. This demand is expected to propel the In-Vehicle Connectivity Market forward, as manufacturers invest in advanced technologies to meet consumer expectations.

Consumer Preference for Enhanced Infotainment Systems

Consumer preferences are shifting towards more sophisticated infotainment systems, which is a key driver for the In-Vehicle Connectivity Market. As of 2025, it is projected that nearly 60% of consumers prioritize advanced infotainment features when purchasing a vehicle. This trend is fueled by the increasing availability of high-speed internet and the proliferation of streaming services, which have raised consumer expectations for in-car entertainment. Manufacturers are responding by integrating cutting-edge technologies such as voice recognition, touch interfaces, and personalized content delivery into their vehicles. This focus on infotainment not only enhances the driving experience but also serves as a competitive advantage in the In-Vehicle Connectivity Market, prompting continuous innovation and investment.