Market Analysis

In-depth Analysis of Immunoassay in R D Market Industry Landscape

Growing economies like India, China, and France are seeing promising opportunities for growth due to increasing populations, especially among the elderly. The large number of people, coupled with a lack of health awareness and the emergence of new diseases, is leading to more research for developing drugs. According to the World Population Prospects 2022 by the Department of Economic and Social Affairs, the global population is expected to reach 10.4 billion by 2100. The rise in diseases like COVID-19, dengue, hepatitis, measles, and HIV is driving the use of immunoassays in research and development, contributing to market growth.

UNAIDS reported 1.5 million new HIV infections worldwide in 2021, with 38.4 million people living with HIV. Additionally, the prevalence of non-communicable diseases like chronic lung disease, heart disease, stroke, cancer, and diabetes is further fueling market growth. According to the World Health Organization, chronic obstructive pulmonary disease (COPD) was the third leading cause of death, causing 3.23 million deaths in 2019. The increasing population and the occurrence of both communicable and noncommunicable diseases are driving drug discovery and development, expected to boost market growth in the future.

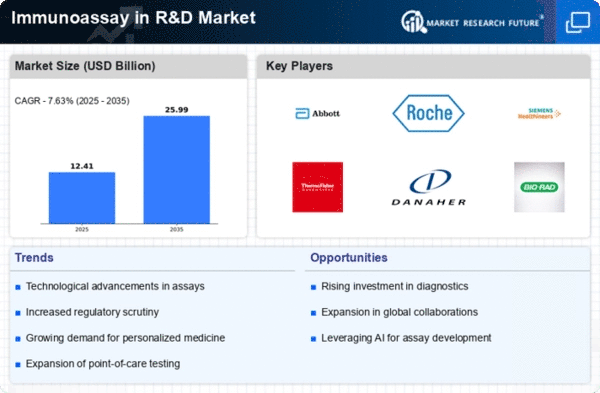

The immunoassays in R&D market are experiencing robust growth driven by various factors. With an increasing demand for these assays across different sectors and continuous technological advancements, the market is flourishing. However, a challenge faced by the industry is a shortage of skilled professionals. Despite this, untapped emerging economies present significant growth opportunities. Immunoassays play a crucial role in pharmaceutical analysis, especially in the diagnosis of diseases, therapeutic drug monitoring, and clinical pharmacokinetics and bioequivalence studies in drug discoveries. The market study aims to provide a comprehensive analysis of the immunoassays in R&D market, examining factors influencing its growth, estimating market size, and offering insights into the competitive landscape.

The demand for immunoassays is particularly prominent in the pharmaceutical and biopharmaceutical industries, contract research organizations, and academic institutes. These sectors witness a rising demand for small molecule drugs, innovative biologics, and regenerative pharmaceuticals & biopharmaceuticals, boosting the utilization of immunoassays in drug and vaccine development. Ongoing trends, such as the increasing approvals of novel therapeutics and growing investments in cell & gene therapy, contribute to the expanding application of immunoassays. Additionally, the rise in demand for precision medicine, attributed to the increasing prevalence of chronic diseases like cancer, heart disease, and diabetes, further stimulates the adoption of immunoassays in R&D.

Leave a Comment