Iff System Size

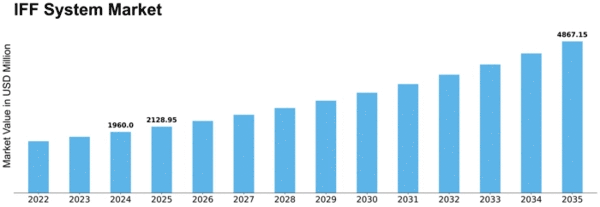

IFF System Market Growth Projections and Opportunities

The factors influencing the Identification Friend or Foe (IFF) System Market are diverse and pivotal, dictating the demand, development, and deployment of advanced identification technologies in aviation and defense sectors. These factors encompass technological advancements, regulatory standards, military modernization, security threats, interoperability needs, and the pursuit of enhanced safety and situational awareness.

The rate of ad-option in innovations is also a significant factor influencing the IFF System Market. From this point, the technologies for developing the IFF are constantly being innovated and continue to improve itself mainly on advanced signal processing techniques, encryption integrity with radar systems, and better modes of identification. The development of technology affects turn market action on the provision of more complex and universal IFF systems that have additional functionality aimed at today’s threats and performance characteristics.

With a lot of responsibilities that regulatory standards and compliance requirements lead tor the IFF System Market. Complex aviation operations and stringent defense protocols require IFF systems that comply with rigorous IFF scheme standards for secure identification and interoperability. Innovation in technology is always associated with such IFF systems that the manufacturers need to produce and this continuous push for innovation gives shape to the market, which basically revolves around technological innovations being driven by current industry regulatory standards.

In the year 2019, initiatives pertaining to military modernization are pivotal key drivers towards spurring demand for IFF System Market. World’s countries’ defense forces are developing their aircraft and defense systems integrations of sophisticated IFF technologies. Such integration is targeted at improving the combat functions, reducing the potential for friendly-fire strikes as well as ensuring good command and control capabilities. The use of innovative modern IFF systems providing better accuracy, solid identification capabilities and variation over various platforms noticeably changes the market flow.

Evolving IFF threats are an important driver of the market for the IFF system. There is also growing demand for IFF technologies best enough to discriminate the true identity of friendlies in ultra-complex battlefields where threats keep evolving. The delivery of new variants for IFF systems which can separate friendlies from adversary while being flexible and adaptive in the operational setting forces participants to push advanced identification technologies.

The interoperability determinants have a rather large bearing on the form of IFF System Market shaping. The setting of IFF systems used in defense organizations, which are designed to contribute to the vigorous satisfactory coordination and communication all over allies. In a response, manufacturers strive to build sophisticated IFF systems that facilitate interoperability, compatibility and ensure reliable operations across different platforms as well as defense systems keeping in mind increasing demand of interoperable identification solutions in the market. Safety and reliability remain paramount factors influencing the IFF System Market. Manufacturers emphasize the development of IFF systems that guarantee accurate and secure identification in various operational environments. Enhanced reliability, accuracy, resistance to interference, and adherence to stringent safety standards drive the demand for IFF technologies that ensure operational safety and mission success.

Leave a Comment