North America : Market Leader in IFF Systems

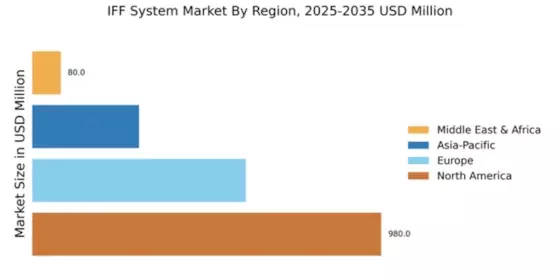

North America continues to lead the IFF System Market, holding a significant share of 980.0M in 2024. The growth is driven by increasing defense budgets, technological advancements, and a focus on national security. Regulatory support from government initiatives further catalyzes market expansion, with a strong emphasis on modernizing military capabilities and enhancing interoperability among allied forces.

The competitive landscape is robust, featuring key players such as Northrop Grumman, Raytheon Technologies, and L3Harris Technologies. The U.S. remains the dominant country, leveraging its advanced technological infrastructure and extensive R&D investments. This region's market is characterized by strategic partnerships and collaborations among defense contractors, ensuring a steady flow of innovative solutions to meet evolving defense needs.

Europe : Growing Defense Investments

Europe's IFF System Market is projected at 600.0M, reflecting a growing commitment to defense and security. The region is witnessing increased investments in military modernization and interoperability among NATO allies. Regulatory frameworks are evolving to support advanced defense technologies, ensuring compliance with international standards and enhancing operational effectiveness.

Leading countries like France, Germany, and the UK are at the forefront of this market, with companies such as Thales Group and BAE Systems driving innovation. The competitive landscape is marked by collaborations between governments and private sectors, fostering a dynamic environment for technological advancements in IFF systems. This synergy is crucial for addressing emerging threats and enhancing regional security.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific IFF System Market, valued at 300.0M, is rapidly expanding due to increasing defense expenditures and regional security concerns. Countries are investing in advanced military technologies to counteract rising geopolitical tensions. Regulatory frameworks are being established to facilitate the adoption of modern defense systems, ensuring compliance with international standards and enhancing operational readiness.

Key players in this region include Elbit Systems and Leonardo S.p.A., with countries like India, Japan, and Australia leading the charge in IFF system adoption. The competitive landscape is characterized by a mix of domestic and international players, fostering innovation and collaboration. As nations prioritize defense modernization, the demand for IFF systems is expected to grow significantly in the coming years.

Middle East and Africa : Strategic Defense Developments

The Middle East & Africa IFF System Market, valued at 80.0M, is witnessing gradual growth driven by regional conflicts and the need for enhanced security measures. Countries are increasingly focusing on modernizing their defense capabilities, supported by government initiatives aimed at improving military readiness. Regulatory frameworks are being developed to ensure compliance with international standards, facilitating the acquisition of advanced defense technologies.

Leading countries in this region include the UAE and South Africa, with a growing presence of international players like Hensoldt and General Dynamics. The competitive landscape is evolving, with partnerships between local and global firms becoming more common. This collaboration is essential for addressing the unique security challenges faced by the region, paving the way for future growth in the IFF system market.