Expansion of 5G Networks

The rollout of 5G networks is a pivotal driver for the Hyperscale Edge Computing Market, as it facilitates faster data transfer rates and improved connectivity. With 5G technology, the potential for edge computing applications expands significantly, enabling more devices to connect and communicate seamlessly. This enhanced connectivity is expected to foster innovations in various sectors, including healthcare, manufacturing, and smart cities. Analysts predict that the global 5G services market will reach USD 668 billion by 2026, underscoring the critical role of 5G in advancing edge computing solutions. As 5G networks become more prevalent, the demand for hyperscale edge computing infrastructure is likely to increase, further driving market growth.

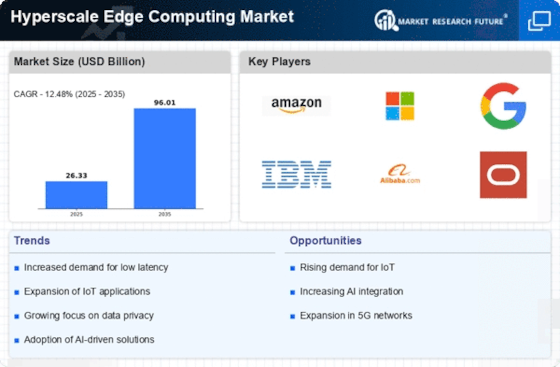

Rising Demand for Low Latency Applications

The Hyperscale Edge Computing Market is experiencing a surge in demand for low latency applications, driven by the proliferation of real-time data processing needs. Industries such as gaming, autonomous vehicles, and augmented reality require instantaneous data transmission and processing capabilities. As organizations increasingly rely on these applications, the need for edge computing solutions that minimize latency becomes paramount. According to recent estimates, the edge computing market is projected to reach USD 43 billion by 2027, indicating a robust growth trajectory. This demand for low latency is likely to propel investments in hyperscale edge computing infrastructure, as companies seek to enhance user experiences and operational efficiencies.

Increased Focus on Data Privacy Regulations

The growing emphasis on data privacy regulations is influencing the Hyperscale Edge Computing Market. As governments and regulatory bodies implement stricter data protection laws, organizations are compelled to adopt solutions that ensure compliance while maintaining operational efficiency. Edge computing offers a viable approach by allowing data to be processed locally, thereby minimizing the risk of data breaches during transmission. The implementation of regulations such as the General Data Protection Regulation (GDPR) has heightened awareness around data privacy, prompting businesses to invest in edge computing solutions that align with these requirements. This focus on compliance is likely to drive the demand for hyperscale edge computing infrastructure.

Growth in Data Generation and Processing Needs

The exponential growth in data generation is a key driver for the Hyperscale Edge Computing Market. With the advent of IoT devices, social media, and digital transactions, vast amounts of data are being created every second. This surge necessitates efficient data processing solutions that can handle the influx without overwhelming centralized systems. It is estimated that by 2025, the world will generate approximately 175 zettabytes of data annually. Consequently, organizations are increasingly turning to edge computing to process data closer to its source, thereby reducing bandwidth costs and improving response times. This trend is likely to catalyze further investments in hyperscale edge computing technologies.

Advancements in Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is a significant driver for the Hyperscale Edge Computing Market. These technologies enable organizations to analyze data in real-time, facilitating quicker decision-making processes and enhancing operational efficiencies. As AI and ML applications become more sophisticated, the need for edge computing solutions that can support these technologies is likely to grow. The market for AI in edge computing is projected to reach USD 1.1 billion by 2026, indicating a strong correlation between AI advancements and the demand for hyperscale edge computing. This synergy is expected to propel further innovations and investments in the sector.