Top Industry Leaders in the Hyperscale Data Center Market

Competitive Landscape of Hyperscale Data Center Market

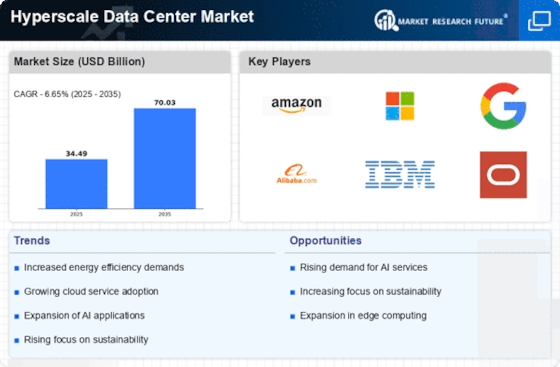

The hyperscale data center market is a dynamic and rapidly evolving space, driven by the ever-growing demand for cloud computing, artificial intelligence, and other data-intensive technologies. As a result, the market is witnessing intense competition between established giants and emerging players, all vying for their share of the pie.

Key Players:

- Cisco Systems Inc. (US)

- IBM Corporation (US)

- Huawei Technologies Co. Ltd. (China)

- Ericsson (Sweden)

- Lenovo Group Ltd. (China)

- Cavium (US)

- Quanta Computer Inc. (Taiwan)

- Broadcom Ltd. (US)

- Intel Corporation (US)

- Others

Strategies Adopted:

- Cloud Providers: Cloud providers are investing heavily in expanding their global data center footprint to reach new markets and offer low-latency services to their customers. They are also focusing on developing innovative data center technologies like modular designs, prefabrication, and liquid cooling to improve efficiency and reduce costs.

- Colocation Providers: Colocation providers are focusing on offering hyperscale solutions to meet the specific needs of large cloud providers and enterprises. They are also investing in renewable energy sources to reduce their carbon footprint and attract environmentally conscious customers.

- Data Center Infrastructure Providers: Leading data center infrastructure providers are focusing on developing next-generation technologies like artificial intelligence (AI) and machine learning (ML) to optimize data center operations and improve efficiency. They are also expanding their services to offer data center design and construction solutions.

- Emerging Players: Emerging players in the hyperscale data center market are focusing on specific niches, such as edge computing and micro data centers. They are also adopting innovative technologies to offer differentiated solutions and compete with established players.

Factors for Market Share Analysis:

Several factors influence market share in the hyperscale data center market, including:

- Global Data Center Footprint: The size and geographical spread of a company's data center footprint are crucial factors for attracting customers who require low-latency services across different regions.

- Cloud Services Portfolio: The breadth and depth of a cloud provider's service offerings influence their market share, as customers tend to choose providers offering a comprehensive suite of services.

- Data Center Efficiency: Companies with energy-efficient and sustainable data centers are gaining traction as customers become increasingly environmentally conscious.

- Innovation and Technology: Companies that continuously innovate and offer cutting-edge data center technologies attract customers looking for the latest advancements in data center design and operation.

- Customer Service and Support: Companies with excellent customer service and support teams gain trust and loyalty from their customers, leading to increased market share.

New and Emerging Companies:

Several new and emerging companies are entering the hyperscale data center market, focusing on specific niches or offering innovative technologies. Some notable examples include:

- EdgeConneX: Specializes in edge data centers located closer to users, reducing latency and improving performance.

- Vantage Data Centers: Offers hyperscale data center solutions for high-performance computing and artificial intelligence workloads.

- Compass Data Centers: Provides modular data centers designed for rapid deployment and scalability.

- QTS Realty Trust: Focuses on developing sustainable data centers that utilize renewable energy sources.

Current Company Investment Trends:

The hyperscale data center market is witnessing significant investments from companies across different segments. Some of the key trends include:

- Focus on Renewable Energy: Companies are increasingly investing in renewable energy sources like solar and wind power to reduce their carbon footprint and operate data centers more sustainably.

- AI and Machine Learning for Data Center Management: Companies are deploying AI and ML technologies to optimize data center operations, improve efficiency, and predict potential issues.

- Modular Data Center Design: The modular design of data centers is gaining traction due to its flexibility, scalability, and faster deployment capabilities.

- Expansion into Emerging Markets: Companies are expanding their data center footprint into emerging markets to tap into new growth opportunities and cater to the growing demand for cloud services.

Latest Company Updates:

On Oct.30, 2023, Vantage Data Centers, a global leader in hyperscale data center campuses, announced the completion of a previously announced investment partnership with a consortium of investors, including DigitalBridge Group, Inc., MEAG, and Infranity in certain Vantage European data center assets. The investment partnership will enable Vantage to employ additional capital to continue fostering its EMEA platform, delivering high-quality hyperscale data center campuses.

On Sep. 14, 2023, Colt Data Centre Services (DCS), a leading provider of hyper-scale and large enterprise data center solutions, launched its first data center in Navi Mumbai, India. The data center marks Colt DCS' strategic expansion and commitment to supporting the increasing demand of hyper-scale cloud service providers and large enterprise businesses in the fast-growing Indian data center market.

On Aug. 25, 2023, CtrlS Datacenters Ltd., a leading Data Centre (DC) operator in Asia and National Telecom Public Company (NT), a telecom provider, announced their collaboration to build a hyperscale data center campus in Thailand. The collaboration will elevate the convergence of data center, cable landing stations & terrestrial networks for CtrlS' first overseas 150-MW data center campus. The greenfield data center campus marks CtrlS' first international market expansion and its first hyperscale data center campus in Thailand.

On May 24, 2023, Lumina CloudInfra, a prominent data center platform, announced the commencement of construction activities of its hyperscale data center in Navi Mumbai. The new state-of-the-art facility is set to encompass multiple data center buildings, boasting an impressive capacity that surpasses 60 megawatts of critical IT load. Lumina CloudInfra aims to bring innovative opportunities to investors and consumers worldwide.