Emergence of 5G Technology

The rollout of 5G technology is set to transform the hyperscale data-center market by enabling faster data transmission and lower latency. This advancement is expected to facilitate the growth of applications such as augmented reality, virtual reality, and real-time analytics, which require robust data processing capabilities. As 5G networks expand, the demand for hyperscale data centers that can support these applications is likely to increase. In 2025, the market for 5G-related infrastructure is projected to reach $50 billion, indicating a substantial opportunity for the hyperscale data-center market to expand its services and capabilities in response to this technological shift.

Rising Demand for Cloud Services

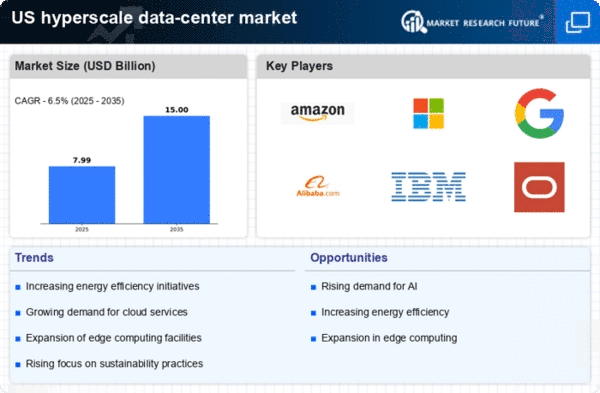

The hyperscale data-center market is experiencing a notable surge in demand for cloud services, driven by the increasing reliance on digital solutions across various sectors. As businesses transition to cloud-based infrastructures, the need for scalable and efficient data centers becomes paramount. In 2025, the market is projected to reach approximately $100 billion, reflecting a compound annual growth rate (CAGR) of around 15% from previous years. This growth is largely attributed to enterprises seeking to enhance operational efficiency and reduce costs. The hyperscale data-center market is thus positioned to benefit from this trend, as providers expand their capabilities to accommodate the growing volume of data and applications hosted in the cloud.

Advancements in Cooling Technologies

Innovations in cooling technologies are playing a crucial role in the evolution of the hyperscale data-center market. As data centers expand, the need for efficient cooling solutions becomes increasingly critical to manage heat generated by high-density computing. Recent advancements, such as liquid cooling and immersion cooling, have shown potential to reduce energy consumption by up to 30%. This not only lowers operational costs but also aligns with sustainability goals. The hyperscale data-center market is likely to see a shift towards these advanced cooling methods, as operators seek to optimize performance while minimizing environmental impact.

Increased Focus on Security and Compliance

As cyber threats continue to evolve, the hyperscale data-center market is witnessing an increased focus on security and compliance measures. Organizations are prioritizing data protection and regulatory adherence, which necessitates robust security frameworks within data centers. In 2025, it is estimated that spending on cybersecurity solutions in the data center sector will exceed $20 billion. This trend indicates a growing recognition of the importance of safeguarding sensitive information. The hyperscale data-center market must adapt to these demands by implementing advanced security protocols and ensuring compliance with industry standards, thereby enhancing trust among clients.

Growth of Internet of Things (IoT) Applications

The proliferation of Internet of Things (IoT) applications is significantly impacting the hyperscale data-center market. With billions of devices connected globally, the volume of data generated is unprecedented, necessitating scalable data processing capabilities. By 2025, it is projected that IoT devices will generate over 79 zettabytes of data annually, creating a substantial demand for data storage and processing solutions. The hyperscale data-center market is poised to capitalize on this trend, as operators enhance their infrastructure to support the influx of data from IoT applications, thereby driving further growth in the sector.