Market Growth Projections

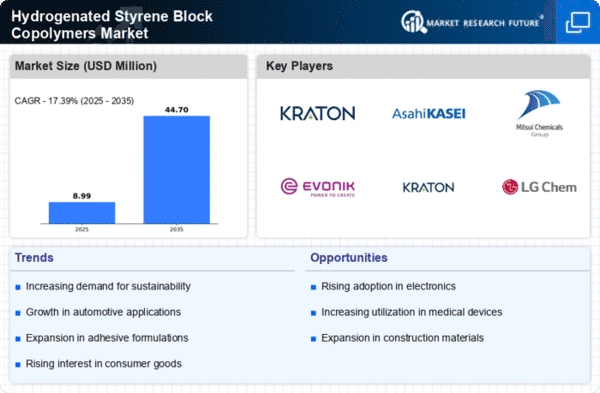

The Global Hydrogenated Styrene Block Copolymers Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 2500 USD Million by 2024 and potentially doubling to 5000 USD Million by 2035, the industry is poised for a robust expansion. The compound annual growth rate of 6.5% from 2025 to 2035 indicates a strong upward trajectory, driven by increasing applications across various sectors, including automotive, consumer goods, and construction. This growth reflects the rising demand for high-performance materials that meet the evolving needs of industries and consumers alike.

Growth in Consumer Goods Sector

The Global Hydrogenated Styrene Block Copolymers Market Industry is also benefiting from the expanding consumer goods sector. These copolymers are favored for their versatility and ability to enhance product performance in various applications, including adhesives, sealants, and coatings. As consumer preferences shift towards high-quality and durable products, manufacturers are increasingly incorporating hydrogenated styrene block copolymers into their offerings. This trend is expected to drive market growth, with projections indicating a market value of around 5000 USD Million by 2035, reflecting a robust compound annual growth rate of 6.5% from 2025 to 2035.

Advancements in Polymer Technology

Technological advancements in polymer science are playing a pivotal role in the Global Hydrogenated Styrene Block Copolymers Market Industry. Innovations in production techniques and formulations are enhancing the properties of these materials, making them more appealing for various applications. For instance, improved processing methods are enabling manufacturers to produce copolymers with tailored characteristics, such as enhanced thermal stability and chemical resistance. This evolution in technology not only broadens the application scope but also supports the anticipated market growth, as industries seek high-performance materials to meet stringent regulatory standards and consumer demands.

Sustainability Trends in Manufacturing

The Global Hydrogenated Styrene Block Copolymers Market Industry is increasingly influenced by sustainability trends in manufacturing. As industries strive to reduce their environmental footprint, there is a growing emphasis on using eco-friendly materials. Hydrogenated styrene block copolymers, which can be produced with lower emissions and energy consumption, are gaining traction as a sustainable alternative. This shift aligns with global initiatives aimed at promoting greener production practices. Consequently, manufacturers are likely to invest in these materials, further propelling market growth and contributing to a more sustainable future in various sectors.

Rising Demand in Automotive Applications

The Global Hydrogenated Styrene Block Copolymers Market Industry is experiencing a surge in demand, particularly within the automotive sector. These materials are increasingly utilized for their excellent elasticity and durability, making them ideal for automotive parts such as bumpers and interior components. The automotive industry is projected to contribute significantly to the market, with estimates suggesting that by 2024, the market could reach approximately 2500 USD Million. This trend indicates a growing preference for lightweight and high-performance materials, which hydrogenated styrene block copolymers provide, thereby enhancing vehicle efficiency and performance.

Regulatory Support for Advanced Materials

Regulatory frameworks supporting the use of advanced materials are contributing to the growth of the Global Hydrogenated Styrene Block Copolymers Market Industry. Governments worldwide are implementing policies that encourage the adoption of innovative materials in various applications, particularly in construction and automotive sectors. These regulations often focus on enhancing product safety and performance while minimizing environmental impact. As a result, manufacturers are more inclined to utilize hydrogenated styrene block copolymers, which comply with these regulations, thereby fostering market expansion and ensuring that products meet the evolving standards set by regulatory bodies.

Leave a Comment