Increasing Industrial Applications

The Hydrogen Peroxide Chemical Indicator Market is witnessing an expansion in industrial applications, particularly in sectors such as textiles, pulp and paper, and electronics. Hydrogen peroxide is utilized as a bleaching agent and a cleaning agent in these industries, which is driving the demand for chemical indicators. The textile industry, for instance, is increasingly adopting hydrogen peroxide for its eco-friendly bleaching properties. Market analysis indicates that the industrial segment is expected to grow at a compound annual growth rate of 4% in the coming years. This growth reflects a shift towards sustainable practices and the adoption of hydrogen peroxide in various industrial processes.

Rising Demand in Healthcare Sector

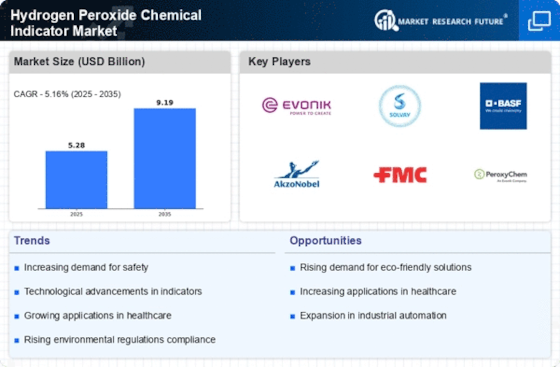

The Hydrogen Peroxide Chemical Indicator Market is experiencing a notable surge in demand, particularly within the healthcare sector. The increasing utilization of hydrogen peroxide for sterilization and disinfection purposes is a key driver. Hospitals and clinics are increasingly adopting hydrogen peroxide-based solutions to ensure a sterile environment, which is crucial for patient safety. According to recent data, the healthcare sector accounts for a substantial portion of the overall market, with projections indicating a growth rate of approximately 6% annually. This trend is likely to continue as healthcare facilities prioritize infection control measures, thereby bolstering the demand for hydrogen peroxide chemical indicators.

Regulatory Standards and Compliance

The Hydrogen Peroxide Chemical Indicator Market is significantly impacted by stringent regulatory standards and compliance requirements across various sectors. Governments and regulatory bodies are increasingly mandating the use of chemical indicators to ensure safety and efficacy in applications involving hydrogen peroxide. This regulatory landscape is driving manufacturers to invest in high-quality chemical indicators that meet these standards. Recent data indicates that compliance with safety regulations is becoming a critical factor for market players, potentially leading to an increase in demand for hydrogen peroxide chemical indicators. As regulations evolve, the market is likely to adapt, presenting opportunities for growth.

Growth in Food and Beverage Industry

The Hydrogen Peroxide Chemical Indicator Market is significantly influenced by the food and beverage sector, where hydrogen peroxide is employed for various applications, including food processing and packaging. The rising consumer awareness regarding food safety and hygiene is propelling manufacturers to adopt stringent quality control measures. As a result, the demand for hydrogen peroxide chemical indicators is expected to rise. Recent statistics suggest that the food and beverage industry is projected to grow at a rate of 5% over the next few years, further enhancing the market for hydrogen peroxide chemical indicators. This growth is indicative of a broader trend towards ensuring food safety and quality.

Technological Innovations in Indicator Development

The Hydrogen Peroxide Chemical Indicator Market is benefiting from ongoing technological innovations in the development of more efficient and reliable chemical indicators. Advances in sensor technology and materials science are leading to the creation of indicators that provide more accurate readings and faster response times. These innovations are likely to enhance the usability and effectiveness of hydrogen peroxide chemical indicators across various applications. As industries seek to improve operational efficiency and safety, the demand for advanced indicators is expected to rise. This trend suggests a promising future for the market, with potential growth driven by technological advancements.