North America : Market Leader in HVAC MRO

North America is poised to maintain its leadership in the HVAC MRO services market, holding a significant share of 46.8% in 2024. The growth is driven by increasing demand for energy-efficient systems, stringent regulations on energy consumption, and a focus on sustainability. The region's robust infrastructure and technological advancements further bolster market expansion, with a rising emphasis on smart HVAC solutions.

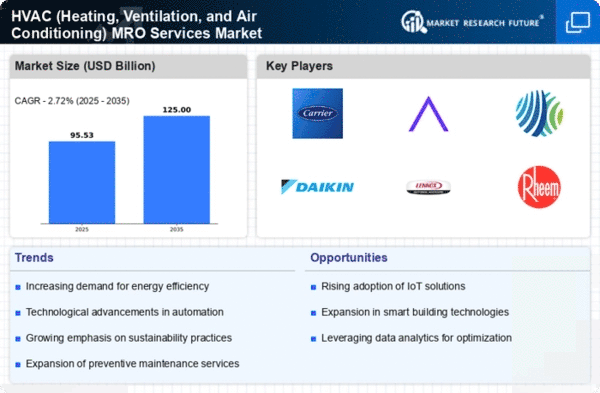

The competitive landscape is characterized by major players such as Carrier, Trane Technologies, and Johnson Controls, which are continuously innovating to meet consumer demands. The U.S. remains the largest market, supported by a strong service network and high investment in building automation. The presence of key players ensures a dynamic market environment, fostering competition and driving service quality.

Europe : Emerging HVAC MRO Hub

Europe's HVAC MRO services market is projected to grow, capturing a market share of 28.5% by 2024. The region is witnessing a surge in demand for energy-efficient HVAC systems, driven by stringent EU regulations aimed at reducing carbon emissions. The European Green Deal and other initiatives are pivotal in shaping market dynamics, encouraging investments in sustainable technologies and retrofitting existing systems.

Leading countries such as Germany, France, and the UK are at the forefront of this transformation, with a competitive landscape featuring key players like Daikin Industries and Trane Technologies. The focus on innovation and compliance with environmental standards is fostering a robust market environment. As the region adapts to new regulations, the HVAC MRO services market is expected to thrive, supported by a strong emphasis on sustainability and efficiency.

Asia-Pacific : Rapid Growth in HVAC Services

The Asia-Pacific HVAC MRO services market is on a growth trajectory, with a market share of 15.0% in 2024. This growth is fueled by rapid urbanization, increasing disposable incomes, and a rising awareness of indoor air quality. Countries like China and India are experiencing significant demand for HVAC systems, driven by industrialization and a growing middle class seeking comfort and efficiency in their living spaces.

The competitive landscape is evolving, with key players such as Mitsubishi Electric and Daikin Industries expanding their presence in the region. The market is characterized by a mix of local and international companies, fostering innovation and competitive pricing. As the region continues to develop, the HVAC MRO services market is expected to expand, supported by government initiatives promoting energy efficiency and sustainability.

Middle East and Africa : Emerging HVAC Market Potential

The Middle East and Africa HVAC MRO services market, while smaller at 2.7% market share in 2024, presents significant growth opportunities. The region is witnessing increased investments in infrastructure and commercial buildings, driving demand for HVAC systems. Additionally, the harsh climate conditions in many areas necessitate reliable HVAC solutions, further propelling market growth. Regulatory frameworks are gradually evolving to support energy efficiency and sustainability initiatives.

Countries like the UAE and South Africa are leading the charge, with a growing number of international players entering the market. The competitive landscape is becoming more dynamic, with companies focusing on innovative solutions to meet local demands. As the region continues to develop, the HVAC MRO services market is expected to gain momentum, driven by urbanization and economic growth.