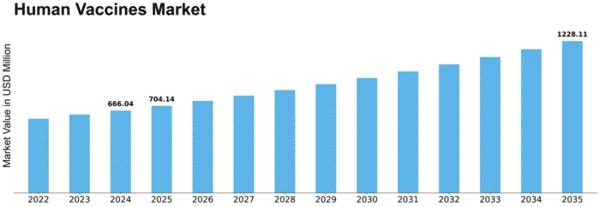

Human Vaccines Size

Human Vaccines Market Growth Projections and Opportunities

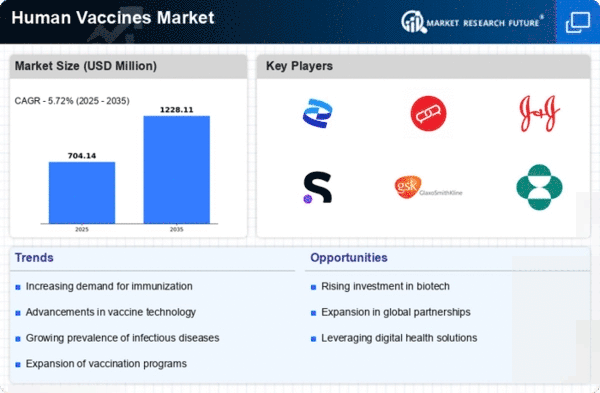

The human vaccines market is impacted by many factors that in combination define its development, which reflects ongoing changes in the incidence of contagious diseases and intervening technologies on a global scale. One of the main catalysts for the human vaccines market is global focus on disease prevention via immunization programs. Nevertheless governments, international organizations and public health agencies operate together on vaccination programs that address several infectious diseases stimulating further demand for the vaccine. Recent pandemics such as COVID-19 have made pandemic preparedness one of the hottest topics in global health. This has led to increased investment in vaccine research, development and production capacities leading inevitably to an increased demand for vaccines against these new viral perils. The market has been profoundly influenced by the constant development of vaccine technology. Revolutionary breakthroughs in mRNA, viral vector and recombinant DNA technologies have opened the path for development of novel innovative vaccines with improved efficacy, safety profiles as well rapid production which serve to benefit growth prospects. The growing campaigns to widen immunization coverage worldwide, particularly in low- and middle-income countries contributes into the development of human vaccines market. International cooperations and partnerships seek to offset restrictions in the accessibility of vaccines, reaching further into preventive immunization. Infectious diseases and the subsequent emergence of new pathogens impact vaccine demand. The emergence of novel infectious threats, or the return to vaccine preventable diseases results in research and development endeavour that would formulate effective vaccines against increasing challenges. Vaccine research and development is effectively fueled by significant governmental funding and support. Public-private partnerships and government risk sharing mechanisms help vaccine manufacturers receive financial incentives, which in turn leads to development of new innovative vaccines as well as timely introduction of such innovations into the market. Increased interest in the benefits of vaccination and public health education initiatives promote greater acceptance by people. Education on the prospect of immunization to prevent infectious diseases promote uptake and improve market demand. There is also increased vulnerability to infections among older adults due to the aging global population and increasing prevalence of chronic diseases The demand of vaccines used on this age group such as influenza and pneumonia vaccine witnesses growth due to which the market expands. The widespread use of vaccines in travel medicine, founded on the growing popularity of global traveling, contributes to market development.

Leave a Comment