Aging Population

The aging population worldwide is a significant driver of the Global Human Insulin Drug Market Industry. As individuals age, the risk of developing type 2 diabetes increases, leading to a higher demand for insulin therapies. By 2024, it is estimated that the number of people aged 65 and older will reach 1.5 billion globally, many of whom will require diabetes management solutions. This demographic shift underscores the necessity for effective insulin products tailored to older adults. Consequently, the Global Human Insulin Drug Market Industry is poised for growth as healthcare systems adapt to meet the needs of this expanding population segment.

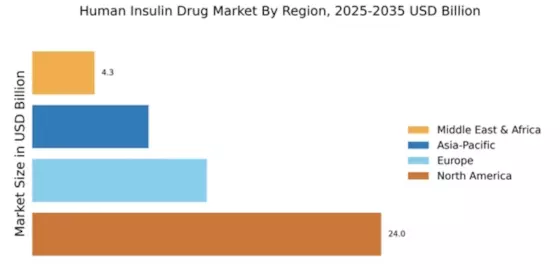

Market Growth Projections

The Global Human Insulin Drug Market Industry is projected to experience substantial growth over the next decade. By 2024, the market is expected to reach 48.3 USD Billion, with further growth anticipated to 73.9 USD Billion by 2035. This trajectory indicates a robust compound annual growth rate (CAGR) of 3.95% from 2025 to 2035. Such growth is driven by various factors, including the rising prevalence of diabetes, technological advancements in insulin delivery, and increased health awareness. The market's expansion reflects the ongoing need for effective diabetes management solutions and the commitment of stakeholders to improve patient outcomes.

Increasing Health Awareness

Growing health awareness regarding diabetes and its management is driving the Global Human Insulin Drug Market Industry. Educational campaigns and initiatives by health organizations are informing the public about the importance of early diagnosis and effective treatment options. This heightened awareness leads to increased screening and diagnosis rates, subsequently boosting the demand for insulin therapies. As patients become more proactive in managing their health, the market for human insulin drugs is likely to expand. The anticipated growth of the Global Human Insulin Drug Market Industry reflects this trend, with a projected CAGR of 3.95% from 2025 to 2035.

Rising Prevalence of Diabetes

The increasing incidence of diabetes globally is a primary driver of the Global Human Insulin Drug Market Industry. As of 2024, approximately 537 million adults are living with diabetes, a figure projected to rise to 643 million by 2030. This surge in diabetes cases necessitates effective management solutions, including human insulin therapies. The growing awareness of diabetes management and the importance of insulin therapy contribute to the market's expansion. The Global Human Insulin Drug Market Industry is expected to reach 48.3 USD Billion in 2024, reflecting the urgent need for insulin products to cater to this rising patient population.

Government Initiatives and Support

Government initiatives aimed at combating diabetes and improving healthcare access are pivotal to the Global Human Insulin Drug Market Industry. Various countries are implementing policies to subsidize insulin costs and promote diabetes education. For example, national health programs are increasingly focusing on providing affordable insulin to underserved populations. This support not only enhances patient access to essential medications but also stimulates market growth. With the Global Human Insulin Drug Market Industry projected to grow to 73.9 USD Billion by 2035, government involvement is likely to remain a critical factor in ensuring the availability and affordability of insulin therapies.

Technological Advancements in Insulin Delivery

Innovations in insulin delivery systems, such as insulin pens, pumps, and smart devices, are significantly influencing the Global Human Insulin Drug Market Industry. These advancements enhance patient compliance and improve glycemic control. For instance, the introduction of continuous glucose monitoring systems allows for real-time tracking of blood glucose levels, facilitating timely insulin administration. Such technologies not only improve patient outcomes but also drive market growth by making insulin therapies more accessible and user-friendly. As the market evolves, these technological improvements are likely to play a crucial role in shaping the future landscape of the Global Human Insulin Drug Market Industry.