Emergence of Green Chemistry Practices

The HPLC Market is witnessing a shift towards green chemistry practices, which emphasize sustainability and environmental responsibility in chemical analysis. As industries become more aware of their environmental impact, there is a growing demand for HPLC Market systems that utilize eco-friendly solvents and minimize waste. This trend aligns with global initiatives aimed at reducing the carbon footprint of analytical processes. Recent reports indicate that the adoption of green HPLC Market techniques has increased by approximately 10% in various sectors, including pharmaceuticals and environmental testing. This movement not only enhances the sustainability of analytical practices but also positions HPLC Market as a vital tool in the transition towards more environmentally friendly methodologies. As regulatory pressures mount, the HPLC Market is likely to see further innovations in green technologies.

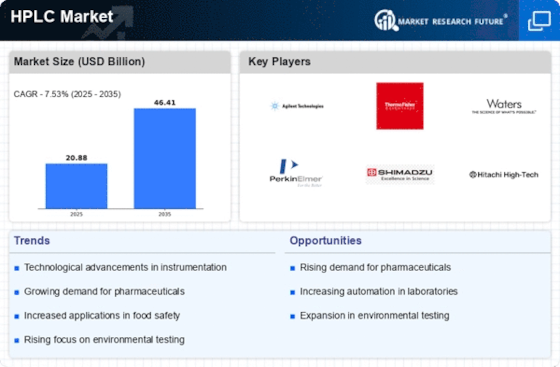

Technological Innovations in HPLC Systems

Technological innovations are a driving force in the HPLC Market, as manufacturers continuously enhance the capabilities of HPLC Market systems. Recent advancements include the development of ultra-high-performance liquid chromatography (UHPLC Market), which offers improved resolution and speed compared to traditional HPLC Market methods. These innovations are particularly beneficial in industries such as pharmaceuticals, where rapid and accurate analysis is critical. Data suggests that the market for UHPLC Market systems is expected to grow by 12% annually, reflecting the increasing demand for high-throughput analysis. Furthermore, the integration of automation and data management software into HPLC Market systems is streamlining workflows and improving efficiency. As these technologies evolve, the HPLC Market is likely to experience sustained growth, driven by the need for more sophisticated analytical solutions.

Increasing Adoption of HPLC in Research Laboratories

The HPLC Market is experiencing a notable increase in the adoption of high-performance liquid chromatography in research laboratories. This trend is primarily driven by the need for precise and accurate analytical techniques in various fields, including biochemistry and environmental science. Research institutions are increasingly investing in advanced HPLC Market systems to enhance their analytical capabilities. According to recent data, the demand for HPLC Market systems in research settings has surged by approximately 15% over the past year. This growth is indicative of the industry's shift towards more sophisticated analytical methods, which are essential for meeting regulatory standards and advancing scientific knowledge. As laboratories strive for higher efficiency and reliability in their analyses, the HPLC Market is poised for continued expansion.

Rising Demand for Quality Control in Food and Beverage

Quality control in the food and beverage sector is becoming increasingly stringent, thereby propelling the HPLC Market forward. The need to ensure product safety and compliance with regulatory standards has led manufacturers to adopt HPLC Market systems for the analysis of food products. This trend is particularly evident in the detection of contaminants and the quantification of additives. Recent statistics indicate that the food and beverage industry has seen a 20% increase in the utilization of HPLC Market for quality assurance processes. As consumers become more health-conscious and regulatory bodies enforce stricter guidelines, the demand for reliable analytical methods like HPLC Market is expected to grow. This shift not only enhances product safety but also reinforces the importance of HPLC Market in maintaining quality standards across the industry.

Expansion of Biopharmaceuticals and Personalized Medicine

The HPLC Market is significantly influenced by the expansion of biopharmaceuticals and the growing trend towards personalized medicine. As the biopharmaceutical sector continues to evolve, the need for advanced analytical techniques to characterize complex biological products becomes paramount. HPLC Market plays a crucial role in the development and quality control of biopharmaceuticals, ensuring that these products meet the necessary safety and efficacy standards. Recent data suggests that the biopharmaceutical market is projected to grow at a compound annual growth rate of 8% over the next five years, further driving the demand for HPLC Market systems. This growth is indicative of a broader trend towards tailored therapies, which require precise analytical methods for their development and monitoring. Consequently, the HPLC Market is likely to benefit from this ongoing transformation in healthcare.