Rise of Home Baking Culture

The resurgence of home baking, particularly in the context of culinary exploration and creativity, appears to be a significant driver for the household flour milling machine Market. As more individuals engage in baking as a hobby, the demand for high-quality, freshly milled flour has increased. This trend is reflected in market data showing a rise in sales of baking-related products, including flour milling machines. Consumers are increasingly interested in experimenting with various types of flour, such as spelt, rye, and gluten-free options, which necessitates the use of milling machines. The home baking culture not only fosters a sense of community and shared experiences but also encourages individuals to take control of their ingredients. Consequently, the Household Flour Milling Machine Market is likely to benefit from this growing interest in home baking, as consumers seek to enhance their culinary skills and create personalized baked goods.

Health Consciousness Drives Demand

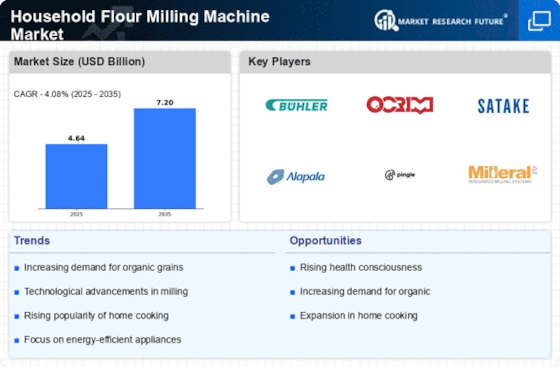

The increasing awareness of health and nutrition among consumers appears to be a pivotal driver for the Household Flour Milling Machine Market. As individuals seek to incorporate whole grains and organic ingredients into their diets, the demand for freshly milled flour has surged. This trend is supported by data indicating that the market for organic flour has expanded significantly, with a notable increase in sales over the past few years. Consumers are increasingly inclined to invest in household milling machines to ensure the quality and nutritional value of their flour. This shift towards healthier eating habits not only reflects a growing preference for homemade products but also aligns with the broader movement towards sustainable and self-sufficient food practices. Consequently, the Household Flour Milling Machine Market is likely to experience sustained growth as more consumers prioritize health-conscious choices.

Customization and Personalization Trends

The trend towards customization and personalization in food preparation appears to be a significant driver for the Household Flour Milling Machine Market. Consumers are increasingly seeking products that cater to their specific dietary needs and preferences. This demand for tailored solutions is reflected in the rising popularity of specialty flours, such as gluten-free and ancient grains, which require specific milling processes. Household flour milling machines provide consumers with the ability to create their own flour blends, allowing for greater control over ingredients and nutritional content. Market data indicates that the demand for personalized food products is on the rise, with consumers willing to invest in appliances that facilitate this customization. As the trend towards personalized cooking continues to grow, the Household Flour Milling Machine Market is likely to see increased interest and investment from consumers looking to enhance their culinary experiences.

Sustainability and Eco-Friendly Practices

The growing emphasis on sustainability and eco-friendly practices among consumers appears to be influencing the Household Flour Milling Machine Market. As individuals become more environmentally conscious, there is a notable shift towards products that promote sustainability. Household flour milling machines align with this trend by enabling consumers to reduce packaging waste associated with store-bought flour. Furthermore, the ability to mill grains at home allows for the use of locally sourced ingredients, thereby supporting local agriculture and reducing carbon footprints. Market data suggests that consumers are increasingly willing to invest in sustainable kitchen appliances, viewing them as a long-term investment in both health and the environment. This shift towards eco-friendly practices is likely to drive demand for household milling machines, as consumers seek to make more responsible choices in their food preparation.

Technological Advancements Enhance User Experience

Technological innovations in the design and functionality of household flour milling machines seem to be transforming the Household Flour Milling Machine Market. Modern machines now feature advanced capabilities such as digital controls, improved grinding efficiency, and noise reduction technologies. These enhancements not only make the milling process more user-friendly but also cater to the diverse needs of consumers. For instance, some machines now offer multiple settings for different types of grains, allowing users to customize their milling experience. The integration of smart technology, such as app connectivity for monitoring and control, further elevates the user experience. As these advancements continue to emerge, they are likely to attract a broader audience, including those who may have previously been hesitant to invest in such equipment. Thus, the Household Flour Milling Machine Market is poised for growth driven by these technological improvements.