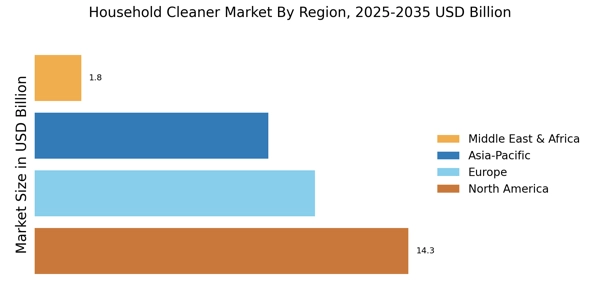

North America : Market Leader in Cleaners

North America is the largest market for household cleaners, holding approximately 40% of the global market share. The growth is driven by increasing consumer awareness regarding hygiene and the rising demand for eco-friendly products. Regulatory support for sustainable practices further fuels this trend, with initiatives promoting biodegradable and non-toxic ingredients. The U.S. leads this market, followed closely by Canada, which contributes around 10% to the overall share.

The competitive landscape is characterized by major players such as Procter & Gamble, SC Johnson, and Clorox, who dominate the market with innovative product offerings. The presence of established brands ensures a high level of consumer trust and loyalty. Additionally, the trend towards online shopping has accelerated, allowing consumers easier access to a variety of household cleaning products, further enhancing market growth.

Europe : Sustainability Focused Market

Europe is the second-largest market for household cleaners, accounting for approximately 30% of the global market share. The region's growth is significantly driven by stringent regulations aimed at reducing environmental impact, alongside a rising consumer preference for sustainable and organic products. Countries like Germany and France are at the forefront, with Germany holding about 12% of the market share, supported by regulations promoting eco-labeling and sustainable practices.

Leading players in this region include Unilever and Henkel, who are actively innovating to meet the demand for greener products. The competitive landscape is marked by a shift towards plant-based ingredients and biodegradable packaging. The European market is also witnessing an increase in local brands that cater to niche segments, enhancing competition and consumer choice.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is an emerging powerhouse in the household cleaner market, holding around 25% of the global market share. The region's growth is propelled by urbanization, rising disposable incomes, and increasing awareness of hygiene standards. Countries like China and India are leading this growth, with China alone contributing approximately 15% to the market. Regulatory frameworks are evolving to support product safety and environmental sustainability, further driving demand.

The competitive landscape is diverse, with both international giants like Reckitt Benckiser and local brands vying for market share. The presence of key players is complemented by a growing trend towards online retail, making household cleaners more accessible to consumers. Additionally, the rise of e-commerce platforms is reshaping purchasing behaviors, leading to increased sales and brand visibility in the region.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa represent a resource-rich frontier for the household cleaner market, holding about 5% of the global market share. The growth in this region is driven by increasing urbanization, a growing middle class, and heightened awareness of hygiene due to health concerns. Countries like South Africa and the UAE are leading the market, with South Africa contributing approximately 3% to the overall share. Regulatory initiatives are gradually being introduced to enhance product safety and environmental standards.

The competitive landscape is characterized by a mix of local and international players, with brands like Ecover and Seventh Generation gaining traction. The market is witnessing a shift towards more sustainable and eco-friendly products, reflecting global trends. Additionally, the expansion of retail channels, including supermarkets and online platforms, is facilitating greater access to household cleaning products, further driving market growth.