Expansion of E-Commerce Platforms

The rise of e-commerce has transformed the way consumers purchase hot tub chemicals, significantly impacting the Hot Tub Chemicals for Residential Application Market. Online platforms provide convenience and accessibility, allowing consumers to easily compare products and prices. This shift towards online shopping is likely to increase market penetration, as more consumers opt for the convenience of home delivery. Additionally, e-commerce platforms often feature customer reviews and ratings, which can influence purchasing decisions. As a result, manufacturers and retailers are expected to enhance their online presence and marketing strategies to capitalize on this trend, potentially leading to increased sales and market growth.

Increased Awareness of Water Safety

With rising concerns about waterborne illnesses, there is a heightened awareness regarding the importance of maintaining clean and safe water in hot tubs. The Hot Tub Chemicals for Residential Application Market is responding to this demand by providing a range of sanitizers and water treatment solutions. Data indicates that the market for water sanitization chemicals is expected to grow significantly, as consumers seek reliable products to ensure their hot tub water remains free from harmful pathogens. This focus on water safety not only enhances user experience but also encourages regular maintenance, thereby driving sales of hot tub chemicals.

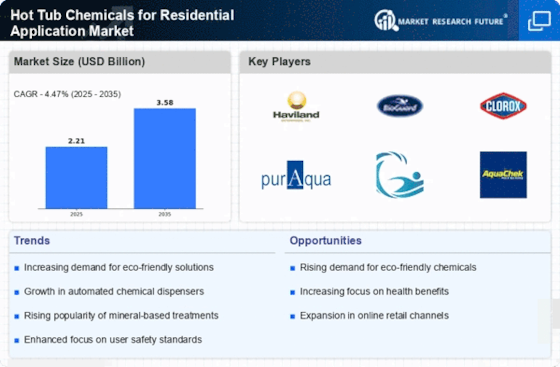

Growing Demand for Eco-Friendly Products

As environmental concerns become increasingly prominent, the Hot Tub Chemicals for Residential Application Market is adapting to meet the demand for eco-friendly products. Consumers are actively seeking sustainable alternatives that minimize environmental impact while ensuring effective water treatment. The market for biodegradable and non-toxic chemicals is projected to grow, as manufacturers respond to this shift by developing greener formulations. This trend not only aligns with consumer preferences but also reflects a broader movement towards sustainability in the home and leisure sectors. Consequently, companies that prioritize eco-friendly solutions may gain a competitive edge in this evolving market.

Rising Popularity of Home Wellness Spaces

The trend towards creating wellness spaces at home has gained traction, leading to increased demand for hot tubs. As consumers prioritize relaxation and self-care, the Hot Tub Chemicals for Residential Application Market experiences growth. The market is projected to expand as more households invest in hot tubs, with a notable increase in sales of chemicals necessary for maintenance. This trend is supported by a growing awareness of the health benefits associated with hydrotherapy, which further drives the need for effective chemical solutions to ensure water quality and safety. As a result, manufacturers are likely to innovate and diversify their product offerings to cater to this burgeoning market.

Technological Advancements in Chemical Formulations

The Hot Tub Chemicals for Residential Application Market is witnessing a wave of innovation, particularly in the development of advanced chemical formulations. These innovations aim to improve the efficacy and ease of use of hot tub chemicals, making maintenance more convenient for consumers. For instance, the introduction of multi-functional products that combine sanitization, pH balancing, and clarifying agents into a single solution is gaining popularity. This trend is likely to attract more users who prefer simplified maintenance routines, thus expanding the market. Furthermore, advancements in biodegradable and eco-friendly formulations are expected to appeal to environmentally conscious consumers, further driving market growth.