Government Initiatives and Funding

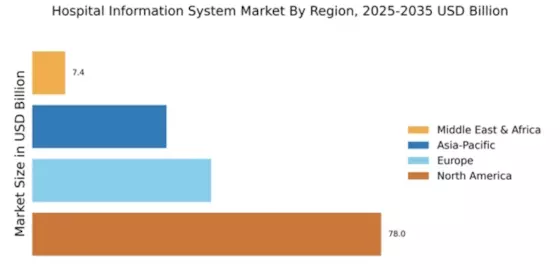

Government initiatives play a pivotal role in the expansion of the Global Hospital Information System Market Industry. Various countries are implementing policies to promote the adoption of health information technologies. For instance, funding programs aimed at enhancing healthcare infrastructure and incentivizing hospitals to adopt electronic health records are becoming increasingly prevalent. These initiatives are expected to contribute significantly to the market's growth, with projections indicating a rise to 127.0 USD Billion by 2035. Such support not only facilitates the integration of advanced technologies but also ensures that healthcare providers can meet regulatory requirements, thereby fostering a conducive environment for the Global Hospital Information System Market Industry.

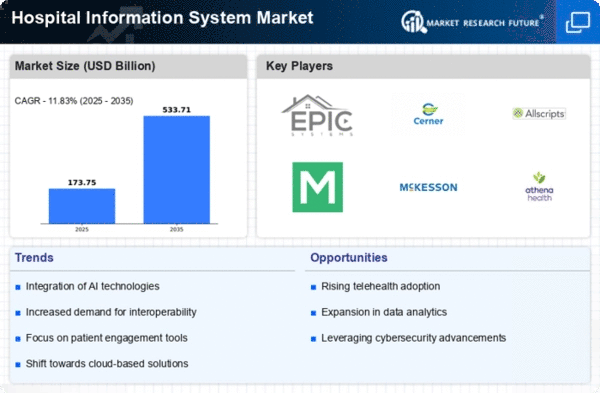

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics is transforming the Global Hospital Information System Market Industry. These technologies enable healthcare providers to analyze vast amounts of data, leading to improved decision-making and operational efficiencies. For example, predictive analytics can enhance patient outcomes by identifying potential health risks before they escalate. As hospitals increasingly adopt these technologies, the market is expected to experience substantial growth, with projections indicating a value of 82.3 USD Billion in 2024. This technological evolution not only enhances the quality of care but also drives innovation within the Global Hospital Information System Market Industry.

Rising Focus on Patient-Centric Care

The Global Hospital Information System Market Industry is witnessing a shift towards patient-centric care, which emphasizes personalized treatment and improved patient engagement. This focus is largely driven by the increasing awareness of patient rights and the demand for transparency in healthcare services. Hospitals are investing in information systems that facilitate better communication between patients and providers, enhancing the overall patient experience. As a result, the market is likely to grow at a CAGR of 4.02% from 2025 to 2035. This trend not only aligns with global healthcare goals but also positions the Global Hospital Information System Market Industry as a key player in the transformation of healthcare delivery.

Growing Need for Regulatory Compliance

The Global Hospital Information System Market Industry is significantly influenced by the growing need for regulatory compliance among healthcare providers. As regulations surrounding patient data security and privacy become more stringent, hospitals are compelled to invest in robust information systems that ensure compliance. This necessity drives the demand for advanced hospital information systems capable of safeguarding sensitive patient information. The market is projected to expand, reaching 127.0 USD Billion by 2035, as healthcare organizations prioritize compliance to avoid penalties and enhance their reputations. Consequently, this trend underscores the importance of regulatory frameworks in shaping the Global Hospital Information System Market Industry.

Increasing Demand for Digital Health Solutions

The Global Hospital Information System Market Industry experiences a notable surge in demand for digital health solutions. This trend is driven by the need for efficient patient management and streamlined operations within healthcare facilities. As hospitals increasingly adopt electronic health records and telemedicine platforms, the market is projected to reach 82.3 USD Billion in 2024. This shift towards digitalization not only enhances patient care but also improves operational efficiency, thereby attracting investments in advanced health IT systems. The integration of artificial intelligence and data analytics further supports this growth, indicating a robust future for the Global Hospital Information System Market Industry.