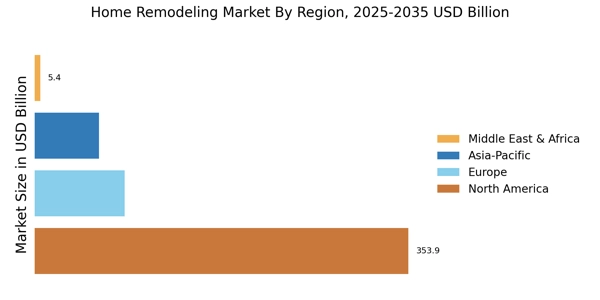

North America : Market Leader in Remodeling

North America dominates the home remodeling market, driven by a strong economy, rising disposable incomes, and a growing trend towards home improvement. The U.S. holds approximately 70% of the market share, followed by Canada at 15%. Regulatory support for sustainable building practices and energy-efficient renovations further fuels demand. Homeowners are increasingly investing in renovations to enhance property value and comfort, especially post-pandemic. The competitive landscape is characterized by major players like Lowe's, Home Depot, and Masco Corporation, which dominate the market with extensive product offerings and services. The presence of these key players, along with a growing number of local contractors, ensures a diverse range of options for consumers. The market is also witnessing a shift towards smart home technologies, with companies adapting to meet evolving consumer preferences.

Europe : Emerging Renovation Hub

Europe's home remodeling market is experiencing significant growth, driven by increasing urbanization, a focus on sustainability, and government incentives for energy-efficient renovations. Germany and the UK are the largest markets, holding approximately 30% and 25% of the market share, respectively. Regulatory frameworks promoting green building practices are catalyzing demand for eco-friendly remodeling solutions, aligning with the EU's climate goals. Leading countries in this region are Germany, the UK, and France, with a competitive landscape featuring key players like IKEA and local contractors. The market is characterized by a growing emphasis on sustainable materials and energy-efficient designs. Consumers are increasingly prioritizing renovations that enhance energy efficiency and reduce carbon footprints, reflecting a broader trend towards sustainability in home improvement.

Asia-Pacific : Rapid Growth in Renovation

The Asia-Pacific region is witnessing rapid growth in the home remodeling market, driven by urbanization, rising incomes, and a growing middle class. China and India are the largest markets, accounting for approximately 40% and 20% of the market share, respectively. The increasing demand for modern living spaces and home improvements is supported by government initiatives aimed at boosting housing and infrastructure development, creating a favorable environment for remodeling activities. Key players in this region include local contractors and international brands, with a competitive landscape that is becoming increasingly diverse. The market is characterized by a shift towards smart home technologies and sustainable materials, as consumers seek to enhance their living environments. The growing trend of DIY renovations is also gaining traction, particularly among younger homeowners looking to personalize their spaces.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is emerging as a potential market for home remodeling, driven by urbanization, population growth, and increasing disposable incomes. The UAE and South Africa are the largest markets, holding approximately 25% and 15% of the market share, respectively. Government initiatives aimed at improving housing infrastructure and promoting home ownership are key drivers of market growth, creating opportunities for remodeling services and products. The competitive landscape is characterized by a mix of local and international players, with a growing number of contractors entering the market. Consumers are increasingly investing in home improvements to enhance comfort and property value. The trend towards luxury renovations is also notable, particularly in urban areas, as homeowners seek to create personalized and high-end living spaces.