Growing Awareness of Plant Health

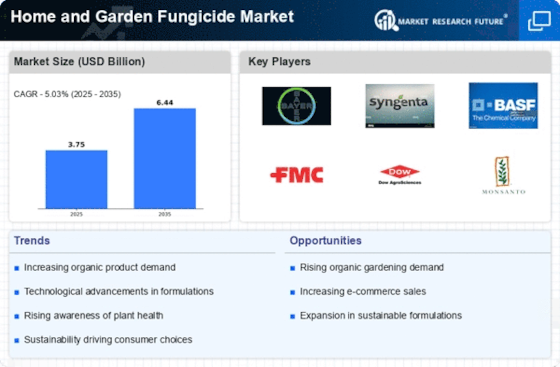

The increasing awareness regarding plant health and the detrimental effects of fungal diseases is a primary driver in the Home And Garden Fungicide Market. Consumers are becoming more educated about the importance of maintaining healthy plants, which directly correlates with the demand for effective fungicides. As gardening becomes a popular hobby, especially among millennials, the need for products that ensure plant vitality is paramount. This trend is reflected in market data, indicating a steady growth rate of approximately 5% annually in the sector. The emphasis on plant health not only enhances the aesthetic appeal of gardens but also contributes to food security, as many individuals engage in home gardening for self-sufficiency.

Increased Investment in Home Improvement

The ongoing trend of increased investment in home improvement is significantly impacting the Home And Garden Fungicide Market. As homeowners allocate more resources towards enhancing their outdoor spaces, the demand for effective fungicides rises correspondingly. This trend is particularly evident in regions where outdoor living spaces are becoming extensions of the home, leading to a greater focus on maintaining plant health. Market data indicates that the home improvement sector is expected to grow by 8% in the coming years, which will likely bolster the fungicide market as consumers seek to protect their investments in landscaping and gardening. This focus on home aesthetics and functionality drives the need for reliable fungicide solutions.

Sustainability and Eco-Friendly Products

The shift towards sustainability is profoundly influencing the Home And Garden Fungicide Market. Consumers are increasingly seeking eco-friendly and organic fungicides that minimize environmental impact. This trend is driven by a growing concern for the planet and a desire to use products that are safe for both humans and pets. Market data suggests that the organic fungicide segment is expected to grow at a rate of 7% over the next five years, reflecting a significant consumer preference for sustainable options. As regulatory bodies also push for reduced chemical usage in agriculture and gardening, manufacturers are compelled to innovate and develop greener alternatives, thereby expanding their product lines to meet this demand.

Urbanization and Limited Space Gardening

Urbanization is reshaping the landscape of gardening, leading to a surge in the Home And Garden Fungicide Market. As more individuals reside in urban areas with limited space, the popularity of container gardening and vertical gardens is on the rise. This trend necessitates the use of fungicides that are effective in confined spaces, where fungal diseases can spread rapidly due to high humidity and limited air circulation. Market analysis indicates that urban gardening products, including fungicides, are projected to see a growth rate of 6% annually. The adaptation of gardening practices to urban settings not only promotes green spaces but also enhances community engagement and environmental awareness.

Technological Advancements in Product Formulation

Technological advancements in product formulation are revolutionizing the Home And Garden Fungicide Market. Innovations in chemical engineering and biopesticide development are leading to the creation of more effective and targeted fungicides. These advancements not only improve efficacy but also reduce the environmental footprint of these products. Market trends indicate that the introduction of new formulations, such as slow-release and systemic fungicides, is expected to enhance user experience and effectiveness. As consumers become more discerning about the products they use, the demand for technologically advanced fungicides is likely to increase, with projections suggesting a growth rate of 5% in this segment over the next few years. This evolution in product development is crucial for meeting the diverse needs of modern gardeners.