Market Trends

Key Emerging Trends in the Holographic Images Market

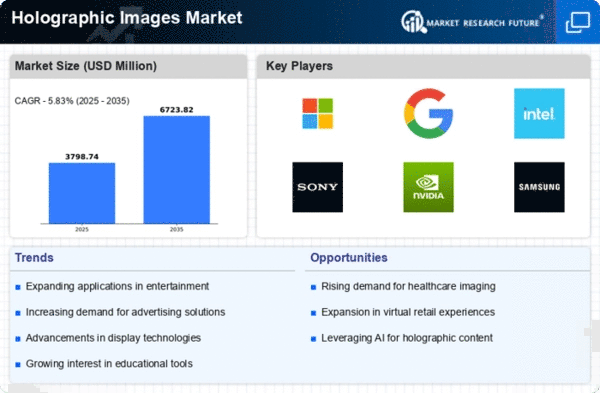

The Holographic imaging market is witnessing dynamic shifts, pushed by means of technological improvements and growing packages across numerous industries. This progressive era has evolved beyond conventional uses and is now finding its way into clinical imaging, enjoyment, schooling, and more. One distinguished trend within the Holographic imaging market is the surge in demand for scientific applications. Holography is revolutionizing medical imaging by imparting three-dimensional representations enhancing diagnostics, surgical planning, and clinical schooling. The market is witnessing elevated adoption in hospitals and clinics internationally. Companies are investing significantly in R&D to push the boundaries of holographic imaging. Continuous innovation is fostering the development of more advanced holographic technologies, contributing to a market boom. This trend is specifically obtrusive as businesses strive to create smaller, more transportable holographic gadgets. Holographic imaging is making waves in training, imparting immersive mastering stories. From anatomy instructions with three-dimensional holographic models to historical reenactments, educators are incorporating holography to make getting to know extra enticing and powerful. The retail quarter is embracing holographic imaging for digital strive-on studies and interactive product shows. E-trade systems are leveraging holography to offer customers a more sensible representation of products, enhancing the net purchasing revel. Despite the demanding traits, demanding situations remain in phrases of commercialization and affordability. High costs related to holographic generation have constrained massive adoption, especially in purchaser markets. However, ongoing efforts to reduce production fees are predicted to cope with this task in the coming years. With the increasing consciousness of sustainability, the holographic imaging market is witnessing efforts to broaden eco-friendly holographic materials and technology. This displays a broader enterprise trend towards accountable and environmentally aware practices. As holographic imaging expands into numerous sectors, regulatory and privacy concerns have become more distinguished. Striking a balance between innovation and ensuring the moral use of holographic technology is critical for enterprise stakeholders and policymakers alike. Collaborations between era businesses, research institutions, and enterprise gamers are at the upward thrust. The purpose of these partnerships is to combine know-how and assets to boost the development and deployment of holographic imaging answers, fostering collaborative surroundings.

Leave a Comment